Fair Value Accounting and Silicon Valley Bank Failure

Analysts, regulators, legislators, and bankers have been attributing the root cause of SVB’s failure in the past month. Some blame the dilution of the Dodd-Frank provisions, others the lack of oversight by regulators, and others still blame social media for exacerbating the deposit run. The root cause of Silicon Valley Bank’s (SVB) failure is poor risk management – plain and simple. Bankers need to understand and manage their business on the fair value of assets and liabilities instead of managing their business on net interest margin and the amortized historical cost of assets and liabilities.

Fair Value versus Amortized Cost

The amortized cost of assets is the accounting treatment applied to securities known as held-to-maturity, or HTM. In the case of SVB, the bank’s HTM securities portfolio was $91.3Bn at the end of 2022, and the bank did not need to provide the fair value of these securities on its balance sheet. However, the market loss of this HTM portfolio was over $15B (disclosed in footnotes), almost equal to the bank’s equity base, making the bank economically insolvent. Further, based on the bank’s own filing, SVB did not deploy hedging instruments to manage its securities duration risk.

While SVB was a public entity and disclosed fair value in footnotes, HTM classification allows private banks to hide market losses from investors, and this also inadvertently fools bank managers. The entire banking industry (analysts, regulators, and bank managers) focuses on net interest margin (NIM), another amortized cost concept. Net interest margin (NIM) is not only a static view of cash flow but also backward-looking. NIM is a measure of the cash flow of the last reporting period; it is not a measure or approximation of current or future cash flows. If SVB’s management team disclosed NIM on a subset of assets and liabilities, measuring its cost of funds (COF) and coupons on fixed-income securities, NIM would appear healthy in 2020 and 2021 until it became sub 1.00% in 2023 when the Fed raised short-term rates by 4.50%.

A Run on Deposit Can be Predicted

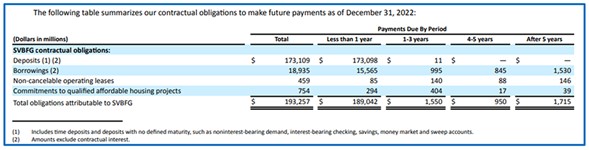

Some analysts argue that a run on bank deposits cannot be predicted. However, fair value accounting can make the economic reality of the bank clear to regulators, investors, and managers alike. Almost 100% of SVB’s deposits were current (less than one-year obligations, as shown by the table below), and over 90% of the bank’s deposits were uninsured. Hundreds of banks in the country demonstrate unrealized losses on securities and loans that represent a substantial portion of common equity, and SVB is not the most brazen example. Unfortunately, if managers are not measuring this unrealized loss and only focusing on NIM, it is less likely that managers will make optimal decisions when booking assets and liabilities.

Relevance of Fair Value

Many industry participants (including FASB) have resisted fair value measures for all assets because of industry pressure, arguments about complexity, or lack of information. However, we argue that fair value measures make sense for the banking industry. A valuation is a measure of risk. Bankers shorten the duration of their investment portfolio as rates rise, and not their loan portfolio, precisely because there is better valuation transparency in the investment portfolio.

The economic world operates in fair value measurements, and fair value measure allows managers to make more informed decisions. Consider the following in the banking industry:

- Banks lend on fair value today, not on the historical cost of the collateral.

- When banks consider sources of liquidity, they evaluate the proceeds from the current sales price and not the original costs.

- Investors want to know the value of the enterprise based on where assets and liabilities will settle today, not where they originated. Investors and creditors want to know a bank’s value of loans, securities, and deposits based on fair value.

- The economic return of a bank is the total return – the periodic payments (NIM) plus the change in the fair value of assets and liabilities.

Even those that argue that fair value is not knowable or reliable still agree that fair value is relevant to the measure of the economic value of the bank. We say that fair value is knowable and reliable for most assets and liabilities at a bank. Even using Level 3 measurements (non-observable) market input values creates better estimates of the economic value of the bank than historical costs. Even Level 3 measures of value for bank deposits would translate into more reliable economic values than a simple historical tabulation of stated deposit balances. Bank core deposits represent a major source of value for depository institutions. They should be recognized at fair value accounting instead of only upon a business combination as an intangible asset.

Takeaway For Community Banks

The current discussion, in the course of recent bank failures, about the relevance and reliability of fair value accounting for banks is similar to conversations had during the great financial crises. If that change comes at all, accounting standards will change very slowly (we hope towards more fair value accounting). However, bank managers will be the first to benefit from such accounting changes because those changes will help bankers focus and measure future cash flows of assets and liabilities instead of focusing on backward-looking measures such as NIM and historical amortized costs. Regardless of how the accounting changes, community bankers should embrace funds transfer pricing, as that concept incorporates fair value accounting principles at the decision-making stage instead of at the account reporting stage. That will be a discussion for a future article.