How to Price Fixed-Rate Loans Without Prepayment Provisions

In a competitive market for commercial clients, each loan feature can be valuable to a community bank. One such loan feature is a prepayment provision on fixed-rate loans. Some community banks offer fixed-rate loans through a hedging program and utilize a symmetrical prepayment provision, others community banks will market their fixed rate loans based on the simplicity of a step-down prepayment provision. Many community banks will waive a prepayment provision under certain circumstances, such as the sale of the collateral or an internal refinance. In this article, we will quantify the value of waiving a prepayment provision on a fixed rate loan as a credit spread equivalent.

Why Prepayment Provisions Matter For Fixed-Rate Loans

There are four main reasons why prepayment provisions increase profitability for banks, as follows:

- Decrease the value of the option held by the borrower to repay the credit when interest rates or credit spreads are lower.

- Increase the lifetime value of the relationship.

- Increase cross-sell and upsell opportunities.

- Reduce negative selection bias in an economic downturn.

The first benefit to a bank in obtaining a prepayment provision is the opportunity cost of committing to a credit and giving the borrower the unilateral right to prepay when changes in future interest rates or credit spreads make it more beneficial for a borrower to do so. Consider a fixed-rate loan to a commercial client in a rising interest rate environment. The borrower is advantaged with a below-market loan rate and will extend duration thereby squeezing the bank’s NIM. Conversely consider a fixed-rate loan to a commercial client in a declining interest rate environment. Without prepayment protection, the borrower can obtain a lower interest rate by refinancing the loan, again hurting the bank’s NIM because a higher earning asset needs to be replaced with a lower earning one. This is an example of a one-way floater loan – borrowers float down, but not up.

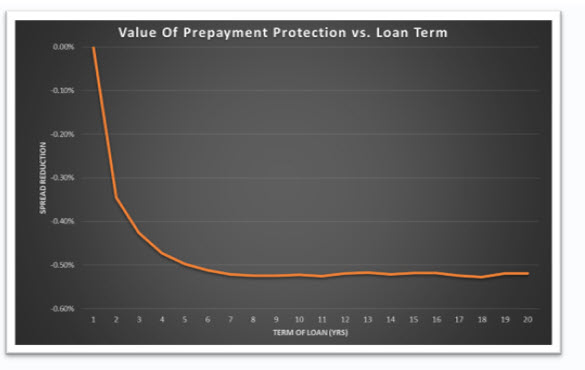

There is a way of measuring the value of this option held by the borrower. We can measure this cost using a capital market tool called an embedded prepayment option. The option to prepay can be approximated with swaption pricing using the volatility surface of forward rates and credit spreads. This credit spread-equivalent cost to the bank is shown in the graph below.

The graph above shows the economic spread reduction for various fixed-rate loan terms when no prepayment provision exists. For a one-year loan, the bank forgoes almost no credit spread, but for a five-year loan, the bank’s economic cost of excluding the prepayment provision is 49bps in yield. The yield reduction caused by lack of prepayment provision bottoms out at 53bps further out on the curve (around 10 years). To state this another way, the bank would be indifferent to a floating rate loan priced at SOFR + 2.50% (as an example), and a credit spread of 2.50% plus 53bps (or 3.03% credit spread) for a fixed rate loan without prepayment protection.

Including a prepayment provision in a loan increases the economic value of that asset. For example, including a yield maintenance provision or a declining balance prepay starting with the fixed rate term of the loan (for a 5-year fixed rate, a 5,4,3,2,1 percent) reduces this economic difference to zero.

Takeaways

There are certain economic, marketing and documentation reasons that community banks may opt for one prepayment provision versus another. However, prepayment provisions in commercial loans do increase profitability for community banks and being able to convert the value of those prepayment provisions to a loan spread is a valuable tool for lenders to consider how to structure and price commercial loans.

We are of the opinion that any prepayment provision is better than none. A prepayment provision that aligns with the borrower’s view of the market and one that allows the borrower to port the provision into future internal refinancings is also a strong marketing tool. Unfortunately many borrowers often negotiate away the prepayment provision since many banks do not quantify the economic value of a prepayment provision.

While most banks will measure and emphasize net interest margin, and some measure the value of fee income, very few banks today are measuring the significant economic advantages of prepayment provisions. The data shows that proper prepayment provision can increase relationship ROE.