Rethinking The Adjustable Rate Loan Structure

Community banks have structured fixed-rate loans for many years with an adjustable repricing feature where a loan is fixed for a number of years and then resets based on a stated spread and an index. However, adjustable term loans have several drawbacks for banks, especially in a rising interest rate environment. One of the most popular adjustable structures is a three, four, or five-year fixed rate that reprices with a spread over an index in the future. The most popular indexes used by banks are Treasuries, swap rates, or FHLB advance rates. The structure partially accommodates a borrower’s request for a long-term fixed-rate beyond a bank’s interest rate comfort level. There are many reasons for community banks to abandon this strategy – in this article, we will consider the credit issue that adjustable-rate term loans create for community banks.

The Credit Issues When Using Adjustable Rates

The most significant credit risk with adjustable-rate loans is the repricing risk. After the initial fixed-rate term, neither the borrower nor the lender can predict the loan payment amount. That is a problematic underwriting position for any bank, especially in an environment where index rates are low, spreads are narrow, and the expectation is for much higher rates in the future.

Consider a standard community bank adjustable-rate term loan: approximately $500k, 75% loan-to-value (LTV), and 1.30X debt service coverage ratio (DSCR), four-year fixed-rate at 4.00% on a 25-year amortization, repricing in four years at the then 4-year treasury yield plus 2.50%. The current four-year treasury yield is about 1.50%, and adding the 2.50% spread would present the borrower with another four years at 4.00% – but only if interest rates do not rise. The risk is that interest rates rise, and the borrower’s net operating income (NOI) or earnings before interest, taxes, depreciation, and amortization (EBITDA) does not rise commensurately.

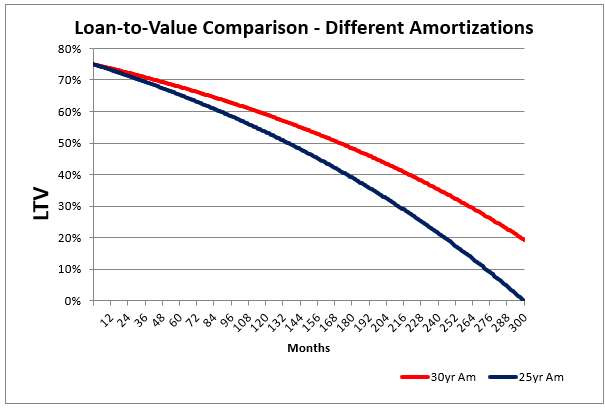

Below is a graph showing the LTV of two loans, one on a 25-year am, and one on a 30-year amortization, and assumes no change in collateral value. The critical point is that on a mortgage-style amortization, the loan principal reduction is very modest over the first few years – less than 5% reduction in LTV occurs over the 4-year period on a 30-year am, and less than 7% on a 25-year am. Therefore, on an adjustable-rate loan, banks set a repricing feature that stresses the primary repayment capacity when the secondary source of repayment has not yet markedly improved.

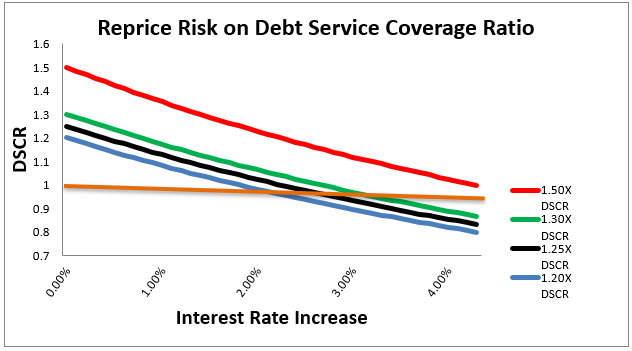

How far do interest rates need to rise for DSCR to be stressed for our loan example above? The graph below shows DSCR for four loans and charts the impact of rising rates on DSCR assuming the adjustable-rate loan repricing. Most banks’ minimum DSCR by credit policy is 1.20X, and under that assumption, a credit that starts at 1.20X DSCR falls below 1.0X cash flow if the loan rate increases by 2.10%. With a starting 1.30X DSCR (the average community bank RE credit and our loan example above), the credit falls under 1.0X cash flow if the loan rate increases by 3.0%. It would take a minimum of 1.50X starting DSCR for a credit to withstand a 4.00% loan rate increase to still cash flow above 1.0X.

However, this is only the tip of the credit iceberg. The spread between the Treasury yield curve and the US bank cost-of-funding yield curve (the swap curve) is currently relatively small. With ample liquidity in the market, the spread between 4-year Treasuries and the swap curve or FHLB advances is only 14 to 20bps. However, that spread is not static and is currently the lowest in history – the highest spread between Treasuries and banks’ cost of funding at 4-years his 132bps. This creates another issue for the bank using adjustable-rate term loans when the loan reprices in four years. The market pricing for similar loans may not be what it is today at 2.50% over the same duration Treasury yields, but it may be 3.00% or 4.00% over Treasuries. Since we are starting with this spread at all-time historical lows, the tradeoff to a bank is not symmetrical.

Finally, the most considerable risk to the bank is probably the most subtle. The adjustable-rate loan creates a credit option for the borrower that banks give away for free. Suppose the credit deteriorates over the initial fixed-rate period or pricing for similar credits is below market. In that case, the borrower will choose to renew the loan at the contractual spread over the index. The borrower will have no better options in the market. Conversely, if the credit improves or pricing is above market, the borrower will attempt to renegotiate terms and pricing or refinance the loan with a competitor. This scenario creates higher prepayment speeds, lower relationship values for banks, and negative selection bias.

Conclusion

We are not sure where interest rates are going but the market, every major economist, and most pundits point higher. While we have discussed balance sheet tactics HERE, moving away from adjustable rate loans should also be considered to better manage risk.

Some banks inadvertently create a much larger credit issue by attempting to avoid interest rate risk. In a rising interest rate environment, with marginal free cash flow (DSCR below 1.50X), banks must carefully consider the impact of future higher rates on the soundness of the credit. Most banks have several viable and inexpensive means of managing interest rate risk, but managing deteriorating credit risk is much more challenging and typically not presented with an easy solution.