Setting Risk For Bank Strategic Planning

When it comes to setting risk for bank strategic planning, contrary to popular belief, risk isn’t something to avoid. Risk is not even an element to minimize. This is counterintuitive as most bankers are taught to avoid and minimize risk. For that matter, most regulators, board members, and investors also reinforce this notion. Take for instance the dozen of credit parameters like maximum loan-to-value (LTV) that are hard and fast rules regardless of the quality or trend of the collateral value and absent of any analysis on pricing. If your limit is 80% LTV, then you will not likely approve many loans that have LTVs above 80%. But what happens if that 82% LTV loan had much better pricing and structure that resulted in lower risk than the average 75% LTV loan? Shouldn’t a bank approve the lower-risk loan? In this article, we challenge the commonly held view on risk with the hopes of deepening bankers understanding that risk, like capital, is available for investment and that getting the risk/reward equation right creates a virtual cycle that attracts capital.

Residual Risk That Meets Strategic Goals

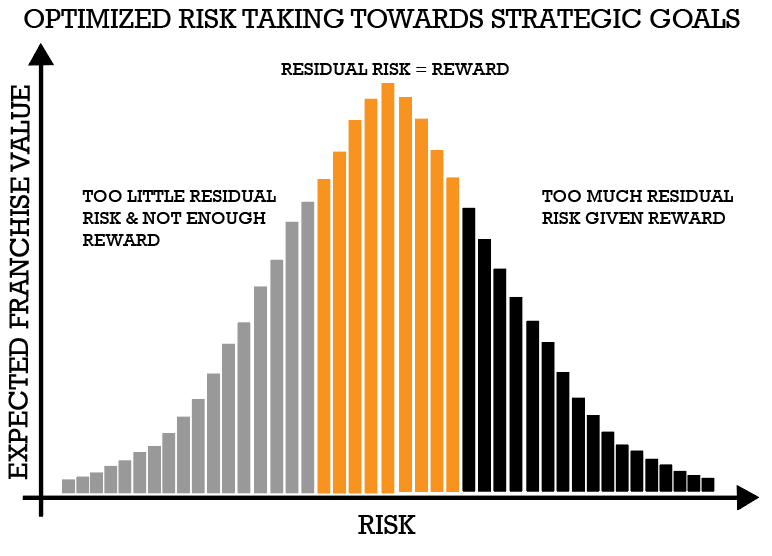

Every decision a banker makes has an impact on risk and return. Some decisions create franchise value, while some decisions destroy franchise value. For any given risk there are mitigants leaving the bank with “residual risk.” The goal of bankers should be to take as much residual risk as possible to the extent they get paid for it AND the risk is in line with the bank’s strategic goals.

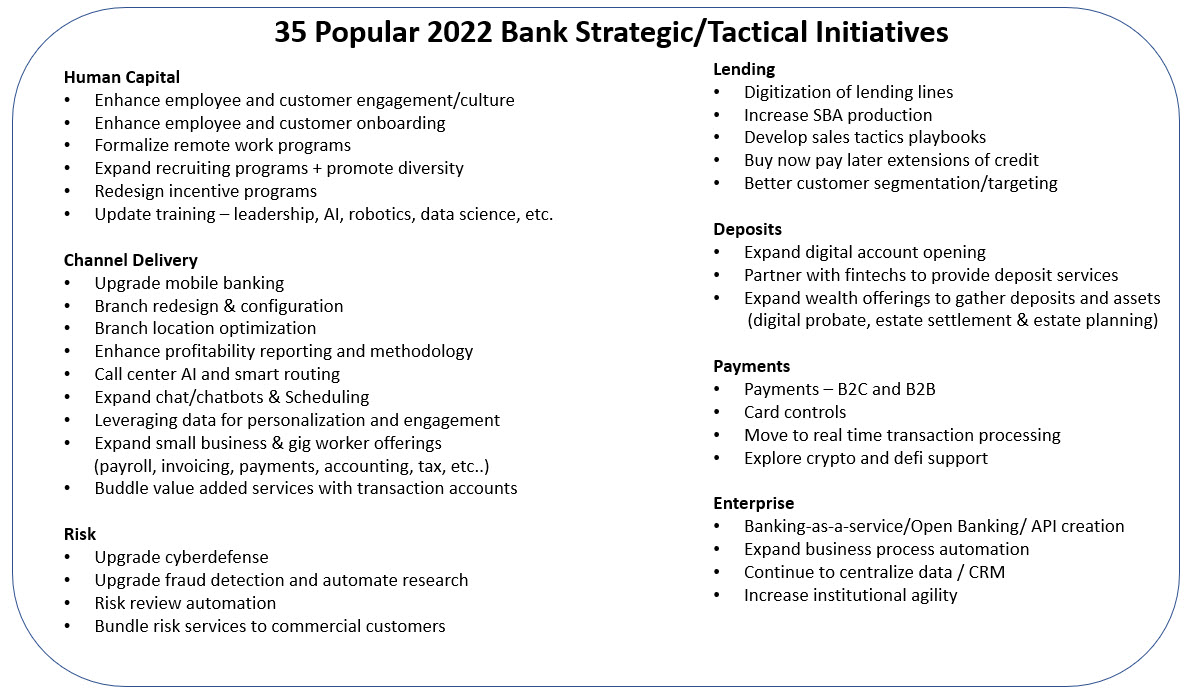

This is a material mindset shift. Given that risk is normally distributed, during bank strategic planning, bankers should be asking “Where can we take on more risk?” as much as they say “How can we further limit risk?” Bankers should train themselves not to look for other activities that everyone else is doing, but activities where they can get paid for taking on their residual risk, regardless of what other banks or fintechs are doing. If other banks are going into “buy now pay later” credit, the question shouldn’t be if you need to do it to keep up, but can you make an outsized risk-adjusted return with the effort. Conversely, there are likely some other business lines where you are not making a below average return that you may need to curtail. To goal with bank strategic planning is to create a portfolio of initiatives that are in the middle of the below spectrum where you can make an above average reward for your residual risk.

That approach is starkly different than how many banks operate in our industry today. Some take risks because it is a good opportunity and not because it furthers their strategic or even tactical goals. More often, bankers look at the gross risk in a vacuum not taking into account risk mitigants or the return generated by such a risk. Finding this optimal risk zone is central to enterprise risk management and should be part of the daily conversation for every bank no matter their asset size or orientation.

Proactively Taking Risk – A Look At Lending

Just like your bank decides where it wants to invest its capital next year, it needs to decide where it wants to “spend” its risk allocation for next year. That is, a bank should proactively state what risk it wants to take on and what risks it wants to avoid.

Communicating your management team’s risk view, not only makes sure everyone is on the same page but helps support a risk-centric culture that speeds decisioning, lowers the drama around decisions, and makes sure there is a dynamic and consistent dialogue about risk within the bank. Does your bank want to drive alpha (returns above average) from certain business lines, by taking credit risk, interest rate risk, operational risk, or something else? The intentional allocation of risk should be done with the same fervor as the allocation of capital.

The question is key to strategic execution because back in 2019 you might have wanted to take more interest rate risk and more credit risk given the state of asset prices, cash flow, and interest rates. Now, for 2022 and beyond, it could be a very different picture.

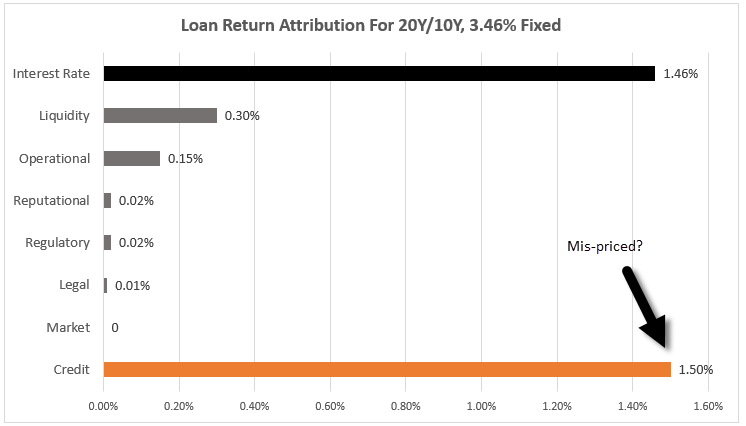

Take for example a $1mm, ten-year fixed-rate loan with a 75% LTV and 1.35x debt service coverage (DSC) in Texas priced at 3.46%. Here, unless you have a particular rate view, the market can tell you exactly what that interest rate risk is worth, in this case, it is worth 146 basis points. In a similar fashion, we can also quantify liquidity risk as we can see the difference between loans and securities for major corporations and rated asset-backed transactions. This “liquidity premium” is somewhere between 10 basis points and 100 basis points with an average somewhere around 30 basis points. The rest of the risk components, operational, reputational, regulatory, and legal risk combined are somewhere around 20 basis points. You can argue with these numbers, but there is almost total agreement that this total is something greater than zero.

Assuming this quantification is correct in this example, we are left with a remaining 1.50% that can be attributed to credit risk. Given the LTV and DSC, a 1.50% spread is likely too low. Even given today’s lower credit risk environment and depending on the location of the property in Texas and the tenant mix, the correct spread should be in the 2.00% range. Anything above that would generate an excess return and build franchise value. Below that pricing level and franchise value are likely to be hurt.

Usually, bankers get the credit spread right but misjudge interest rate and liquidity risk. In this case, at 1.46% the banker should be indifferent to making a fixed or floating rate loan.

The key point here is to have a working knowledge of your component parts of the loan to understanding where you are taking the risk and how you are getting compensated for it. The same is true for other areas of the bank. To optimize risk-taking, bankers need to know what risks they want to take and where they want to take those risks.

Activity Risk Within The Bank Strategic Planning Construct

If a bank is a better lender, a better deposit gatherer, or has a niche business where they can generate excess return given the risk, then likely they are “generating alpha” or creating excess returns above the bank’s cost of capital. Similar to what risks a bank wants to take, a bank needs to understand where it wants to take those risks. In the past, some banks have done very well just focused on deposit gathering and then leverage those deposits by making investments. These days, because of low rates and the shape of the yield curve, driving alpha from deposits is difficult.

By looking at the returns for each department, bank management can then compare those returns to their peers to have a clear view of where they excel and where they underperform. Capital and risk should be allocated to those areas where a bank wants to expand. This adds another dimension as not only should management be clear on what investment is needed to expand the business, but if the business does expand, what is the increase in risk, and does this risk generate enough of a return to compensate for the capital invested AND the risk.

Of course, the opposite can be done. For example, a five-year annualized return for the S&P is 15.5% while most publicly traded banks are producing an annualized return of 12.7%. These figures can serve as base hurdle rates in which to benchmark any strategic initiative. An initiative first has to clear your bank’s preset hurdle rates and then the initiative owner should detail the component parts of that return to show how the risks break down.

Alpha From Bank Strategic Planning

During this time of the year, banks will be taking a look at their entire business model and ask, “Is this where we want to generate our alpha going forward?” Do you have the right geography, the right business lines, and the right bets on risk?

Bank strategic planning can be an alpha generator in itself as it is a time to take a look at where you want to invest more or less risk and capital. Chances are banks will start to decrease capital and risk allocations around interest rate risk and credit while increasing the capital and risk allocation towards fee lines and operational risk.

Every bank management team is a portfolio manager of excess capital and risk while an owner of an existing set of business lines (for further reading at making your bank an innovation incubator, go HERE). As a portfolio manager, bankers should have intent on where, when, and how to take risks. Each capital decision should be tied to a risk decision as you can invest capital to increase or decrease risk or you can choose to reduce capital to increase or decrease risk. This is a four-option decision that is very different than how most banks think of risk management.

By using this methodology, you can increase or decrease both capital and risk until you feel your investment moves into the sweet spot of risk optimization. By doing so, you will find that you can generate more alpha which, in turn, be able to attract more capital, which will then lower your risk so you can then invest that risk to generate more alpha. This is what is called the virtuous cycle of risk management.