The Concentric Relationship Strategy in Banking

In recent articles (here and here and here), we discussed why banks that take risks to earn higher revenue demonstrate lower performance as measured by return on assets (ROA). Empirical evidence, historical bank failures, and common sense teach us that many risks do not translate to higher yields. We analyzed why pay-for-risk does not lead to higher performance, whether that risk is credit or interest rate risk. We concluded that the market does not adequately compensate banks for credit and interest rate risks. Today, we look at the value of concentric relationship building.

Top-performing community banks deploy relationship banking. We define relationship banking as a model focused on a consultative banking approach. Bankers provide advice based on the customer’s particular situation and needs, as those needs evolve over the customer’s lifetime and as the market changes. The bank is compensated by selling products, services, and especially insightful and targeted advice.

Many community banks state that they embrace and promote relationship banking, but the model is not easy to deliver effectively, and its implementation is not as intuitive as some bankers may believe. To implement the relationship business model, bankers must focus on the right talent, education, product mix, and executive support. Banks developing and delivering a relationship banking model can outperform the industry. However, community banks must attract, develop, and retain commercial bankers who can offer insightful financial advice.

This article shares a simple strategy a successful lender (Linda N.) uses at our bank. We saw how Linda used her relationship strategy to increase her relationship banking skills, connections, and success rate. We have shared this strategy with other lenders who have used it successfully to increase loan booking rates and portfolio profitability.

Success Factors in Relationship Banking

Since relationship banking success relies on the lender providing insight and advice to the customer, the successful relationship banker must develop expertise that customers find helpful and valuable. Banking expertise comes from experience and intellectual curiosity (learning). Therefore, commercial lenders must develop a strategy to increase industry knowledge in finance, business, accounting, tax, mergers/acquisitions, or other fields. Linda called her approach concentric relationship building. Concentric relationship building is simple and premised on learning from one account and applying the knowledge gained to the following account in the same industry, same vertical, or similar point of the business cycle.

Concentric Relationship Building

Linda identified two steps in her concentric relationship strategy. The first step is to identify the industry where the lender can gain the most knowledge and have the highest opportunity. The second step is identifying prospects and building from one to many relationships.

First Step

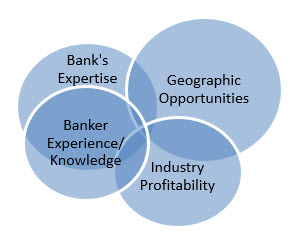

Here is how Linda decided which industry to pursue – she analyzed only four criteria for her focus, as shown in the graph below.

Linda would identify the following criteria to target an industry:

- The banker’s own knowledge and experience: This was the least essential criterion since Linda felt she could learn and change her expertise through study and experience. In Linda’s case, she had good knowledge of hospitality because her relative ran a hotel for many years. In her years as a lender, Linda acquired expertise in four other industries and became knowledgeable in tax and M&A strategies. Lenders have different backgrounds and interests, but anyone can learn a new sector or develop vertical or business-level expertise.

- Linda would focus on profitable industries: Unprofitable customers do not make good borrowers and do not generate high ROE for banks. Linda identified industries that could consistently generate cash flow in up-and-down cycles, such as medical professionals, accountants, and funeral homes.

- Identify borrowers in your region: For example, aviation companies may be profitable, and a lender may understand that industry well, but if there is only one bankable aviation company in your driving radius, you cannot create concentric relationship building. Linda believed you must identify a critical mass of borrowers in your region that you can learn from and apply that knowledge to the next customer in that industry.

- Ensure that your bank has the expertise and willingness to lend in a specific industry and has the products and services that the industry needs. If you want to emphasize commercial and industrial (C&I) loans to financial advisors, but your bank only lends on real estate collateral, you will have a hard time developing a relationship banking model in the C&I field. Make sure that the industry you pick is a good fit for your bank’s appetite, or you must find another employer.

Second Step

In the second step of the concentric relationship-building model, Linda would reach out to her focus industry prospects and try to gain an audience with decision-makers. This is the most critical step in Linda’s model and where most lenders fail. We talk to many lenders who lament that they wish they could meet with more prospects. Referral business is great, and introductions at the chamber of commerce lunches, city council meetings, and corporate boards are also great. Still, Linda found the vast majority of her initial customers through simple database mining, followed by cold calling and marketing.

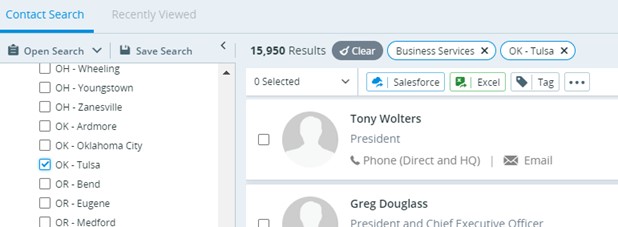

Here is an example of Linda’s process. She identified a desired geographic region, and her database would list all businesses in the region, as shown in the screenshot below.

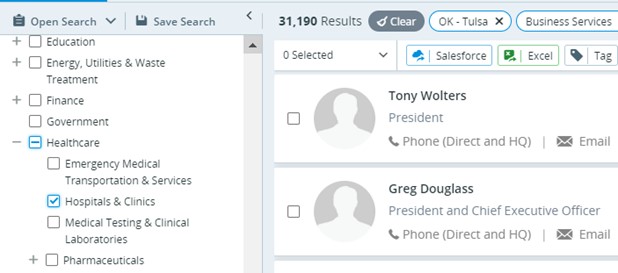

Next, Linda searches for industries she is targeting, and in the screenshot below, she identifies hospitals and clinics.

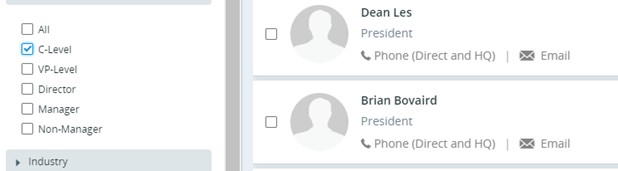

Then Linda searches all of the decision-makers in this subset (c-level people).

Linda now has over 1,000 results (C-level executives within the targeted industry and in her geographic reach). She sends out a letter that describes why she wants to meet with the prospect. Once Linda closes a loan for one hospital or clinic, the next customer in the concentric circle is much easier to close because Linda now has credibility, industry knowledge, and a referral source. Linda keeps building on her success by expanding the concentric relationship. Following this strategy, we witnessed that Linda could build five, ten, and sometimes even 20 customers within one industry.

Putting Concentric Relationship Building Into Practice

Like every successful sales activity, the process is critical. The concentric relationship strategy is one way commercial bankers can increase their effectiveness. The process works for Linda and many other lenders. The concentric relationship-building process is simple, inexpensive, and effective for many seasoned and young lenders alike. Banks should consider being more methodical about the practice of prospecting and relationship building. This methodology needs to be trained, practiced, and managed. For banks that do, they will find that their calling efforts become exponentially more effective.