The Updated Dangers of Net Interest Margin

Most bankers and analysts believe that maintaining net interest margin (NIM) is crucial for bank profitability. Many community banks are working hard to maintain NIM and thus profitability (ROA) – so the thinking goes. However, the current focus on NIM may actually be hurting banks’ performance.

The Dangers of Net Interest Margin

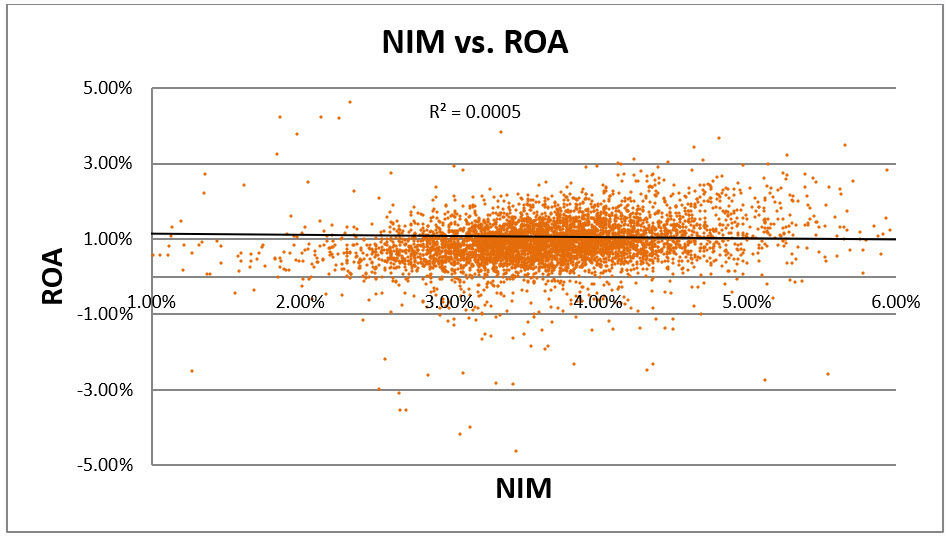

We have tracked NIM and return on assets (ROA) for all operating (and defunct) banks in the country for the last 15 years. The data shows no relationship between NIM and ROA. Banks with higher NIM do NOT perform better than banks with lower NIM. The graph below shows all operating banks in the country and plots NIM and ROA. The correlation between NIM and ROA is close to zero.

The emphasis on maintaining or increasing NIM is premised on the false assumption that banks can book the same assets (loans and securities) at higher or lower yields depending on their pricing strategy or negotiating tactics or simply by maintaining pricing vigilance. But this is a false premise.

It is not hard to improve NIM, but very difficult to improve ROA. NIM can be maximized by booking smaller and less credit-worthy loans and substituting transaction loans for relationship loans. However, while this strategy leads to higher NIM, it also leads to lower ROA.

The Current Environment

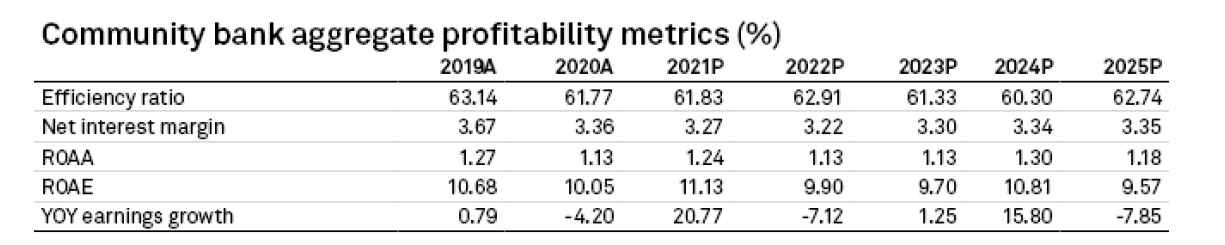

While strong credit quality and the tail end of PPP loans will allow community banks to recognize earnings growth in 2021, earnings will be under pressure in 2022 and 2023. The challenge facing community banks is putting excess liquidity to work, tepid loan growth, and intense competition. As shown in the table below, from S&P Global Market Intelligence, community bank NIM is forecasted to continue to be suppressed through 2025.

Facing current market challenges, community banks should find ways to be more efficient, expand their product offering to generate fee income, or add assets outside their geography or normal origination channels rather than try to generate more NIM that is currently unavailable because of market dynamics.

Recent Example of the Dangers of Net Interest Margin

Here is a prime example of banks maintaining NIM at the expense of ROA. Recently, a borrower in Oklahoma approached the lender to ask for a reduction in rate (this $3.7mm loan is currently priced at an adjustable index plus 2.65%). The banker responded that the loan was already very thinly priced, and the bank could not afford to concede on the rate. The borrower found a refinancing option at a 54bps lower rate and presented the banker with an option to match the rate. When the banker refused, the borrower threatened to leave the community bank. However, the loan had an existing onerous prepayment penalty that the banker would not waive. The borrower, disgruntled, decided to stay with the existing loan. The bank retained the loan and maintained NIM, but the ROA for the bank declined because the banker converted a relationship customer to a transactional customer. When the prepayment penalty burns off by 2023, the borrower will leave the bank – he already stated that to the lender.

Instead of maintaining the NIM, the banker should have offered to lower the credit spread from 2.65%, with some additional sweeteners from the borrower. In return for a lower spread, the lender could have asked for additional treasury management business, another credit opportunity, or an opportunity to refer more business to the bank. A 25bps reduction in the credit spread would decrease the bank’s ROE on the loan by 2.3%, but the additional sweeteners from the borrower have the potential to increase ROE by more than 10%. The focus on NIM destroyed value for the bank.

Conclusion

When banks focus strictly on NIM, other aspects of value creation are overlooked. Without careful consideration, higher NIM may directly detract from ROA. Loans that are smaller, less creditworthy, transactional, and offer less cross-sell opportunities or provide shorter lifetime value result in lower ROA but higher NIM. The old saying in banking is that “loans are not manufactured in a petri dish,” and there is a reason why one loan is priced higher than another. We continue to see where misplaced emphasis on NIM sets up some banks for challenging circumstances in the near future. Banks should embrace RAROC models and take a more nuanced view of relationship pricing and consider measures beyond NIM.