10 Ideas On How to Optimize Analyzed Checking (Part 2)

If managing loan pricing is a college-level course, deposit pricing is a master’s. Given the complexity, managing analyzed checking, however, is a PhD. level effort. There are all the dynamics of traditional accounts plus often two different interest rates, the ability to offset fees, and a variety of adjustments. We covered the basics of account analysis in Part 1 (HERE), and in this article, we highlight best practices for managing an analyzed transaction account.

Analyzed Checking Account Complexity

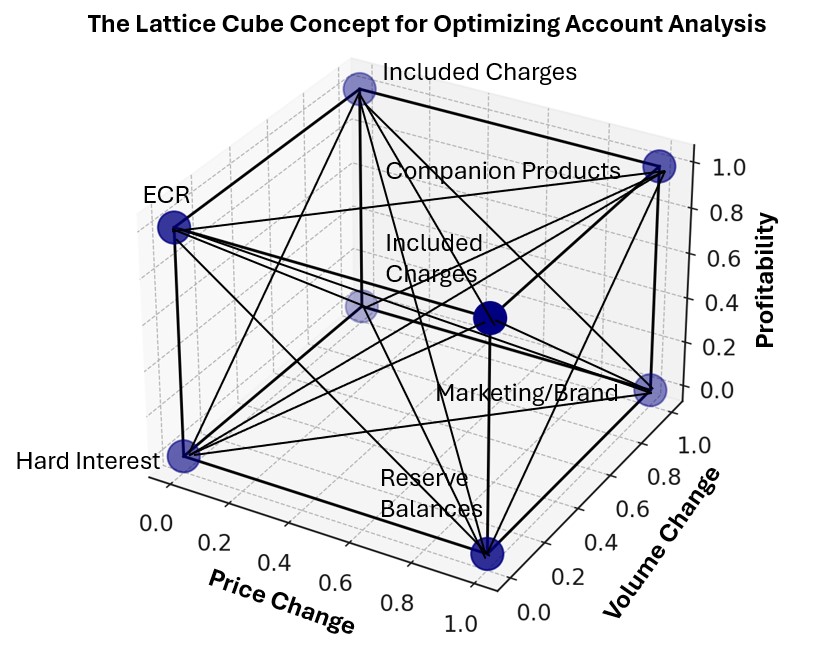

While we prefer calling this type of account an “analyzed transaction account,” as most accounts have far more payment transactions than checks, we will stick with the traditional nomenclature for this article. To set the elements for pricing and performance, there are essentially eight characteristics of the account to manage – the earnings credit rate (ECR), the hard interest charges, if any, the charges that are eligible to be offset by the ECR, the charges that are not offset, the reserve balance if any, the marketing position/brand of the bank and the performance of the associated companion products to include non-analyzed checking, business savings, business money market accounts and certificates of deposit.

For analysis, the framework can be put in a “lattice cube” with each interrelated element in a corner. Each element has a cross-effect on its adjacent neighbor (called a “Moore Neighbor”) AND diagonal neighbor (called a “Von Neumann Neighbor”). Four product variables impact profitability – rate, fees, marketing/brand, and companion products for a standard bank product such as a business savings account. For analyzed checking, you not only have an additional interest rate (ECR) but also the impact of the ECR on items like fees, charges, and reserve balances. These characteristics make quantifying product performance much more complicated.

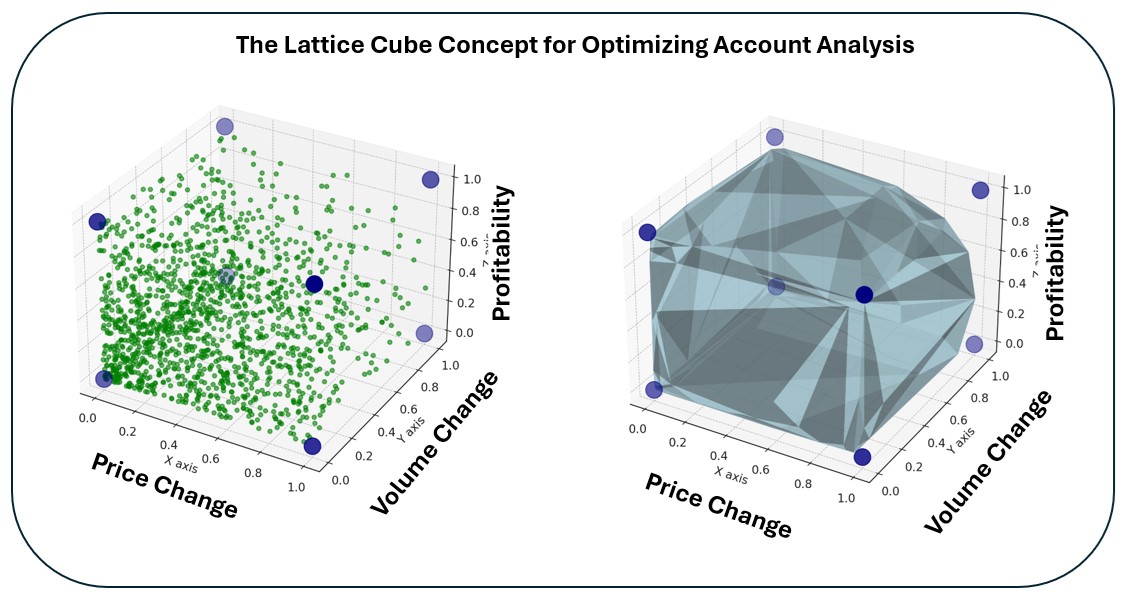

Placing the element at the zero position, you can then chart how the change in price on the x-axis impacts the change in volume on the y-axis and how both elements interact to effect a change in profitability on the z-axis.

You end up with a set of data points in three-dimensional space that, when the perimeter points are connected, turns into a sphere or, more technically, a spheroid. This spheroid is asymmetrical as deposit performance is heavily influenced by ECR, hard interest, companion products, and marketing/brand. Items such as reserve amount, included charges and excluded charges have little impact on building balances and deposit performance. Graphically, it looks something like the visualizations below.

If all this seems too complicated, it is. The impact of many of these elements doesn’t matter, as the customer rarely grasps the impact of price changes. As such, these elements have little impact on volume and profitability. Because of this relationship, it doesn’t pay to manage these lower-impact elements. The elements that do matter—ECR, hard rate, and fee level—have an outsized impact on profitability and should be the focus of bank product managers.

Below are some additional recommendations.

1) High Rate/High Fees vs. Low Rate and Low Fees

When it comes to analyzed checking, the first thing to get right is pricing positioning as this decision will drive the profitability arc of the product.

The basis of driving value in analyzed checking, like any deposit account, is to get the combination of service, rate, and fees just right for the market segment to drive satisfaction and profitability. Analyzed checking exists, in its current form, primarily to provide a product profile angle to drive value. With analyzed checking, you can offer a high ECR, such as 5% in this current market, and have your fees such that you can lower your effective rate to 0%.

Offering a high rate while having high fees is tempting and does end up reducing your customer acquisition cost while shortening the sales cycle. Analyzed checking is the superior product for attracting profitable customers compared to a high-yield checking, savings, or money market account.

There is nothing better than promoting a high rate to attract and please customers—except for one glaring problem—rate sensitivity. Banks that take the high rate/high fee approach train their customers and employees to be rate, and fee-sensitive. This tactic starts a disingenuous relationship with everyone, likely hurting a bank’s brand and value proposition.

Customers who are attracted to high rates usually are attracted to low fees. While approximately 30% of the customers don’t focus on both attributes and are either rate or fee-sensitive, but not both, banks still run the risk of getting caught in this “parlor trick” of a tactic. Sophisticated customers will see through this tactic and look at the effective rate of the account. Other customers will learn over time, especially when they are courted by other banks that will be more than happy to call out this tactic, thereby putting your bank on the defensive.

When it comes to fees in isolation, fee levels are important for attracting and onboarding customers. Commercial customers make decisions based on a bank’s rate schedule, along with ECR and hard interest. However, raising or lowering fees once an account is open has relatively little impact on balances. Thus, it is better to raise fees than lower ECR or hard interest if the bank is trying to increase profitability. The opposite is also usually true. Lowering fees will likely not result in increased volume and profitability.

Unless you are a credit card or captive finance bank with a healthy historical net interest margin, having a high rate/high fee structure in analyzed checking ends up eroding a bank’s brand and results in shorter than average customer lifetime value. Paying a high rate for analyzed accounts is better than paying a high rate in other products, but not much better when it comes to account profitability.

2) Don’t index rates

Many banks peg their earnings credit rate to an index, such as the three-month Treasury bill, and go off a percentage of that index, such as 30% to 40%. While easy and transparent, this single move likely destroys the most performance as you leap in beta. Banks that index either the ECR or hard rate give up all optionality and train both customers and employees to align value with market movement, thereby giving up control.

3) Hard Interest

While paying hard interest on account analysis used to be more prevalent than it is today, some banks still practice this tactic. Paying hard interest puts banks in the rate game and not the service game which hurts bank profitability. Paying hard interest on balances after adjusting for the earning credit is attractive and is by far the best tactic to build balances. However, like paying a high ECR, it trains customers and employees to be rate sensitive thereby hurting long-term deposit performance and lifetime value.

The relationship between hard interest and volume is one of the more linear responses within account analysis. Dispersion is tightly grouped meaning there is more predictive power and reliability with this product element in controlling volume. Pay more hard interest and volume will likely increase as commercial customers pull money from other accounts. However, as hard interest increases, profitability decreases.

To improve account analysis performance, don’t pay hard interest and if you do, choose a rate level that properly reflects the pricing position you want your bank to be at.

4) Earnings Credit Rate

Of all your product elements, it is no surprise that the ECR has the second most significant impact on volume and profitability behind hard interest. While accounts are not as sensitive to an ECR change as they are with hard interest, they are still relatively responsive. There’s a positive relationship between changes in price and changes in volume, meaning that as the ECR increases, volume tends to increase as well.

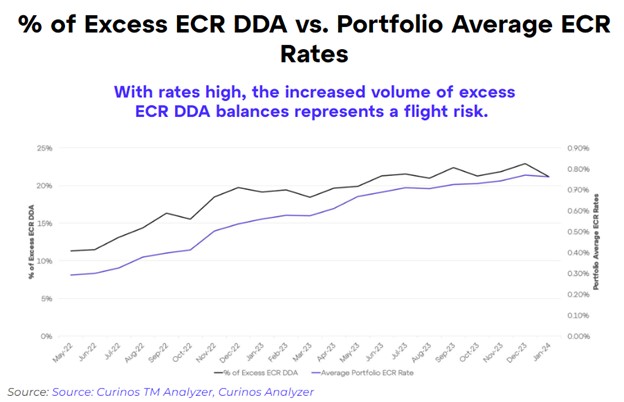

The increase in rates over the last several years have created a greater amount of “excess” balances. An excess balance is an earnings credit amount above what is needed to pay for the account costs. According to Curinos, excess ECR balances composed 11% of total balances back in 2022 when the average earnings credit was 29 basis points. At the start of 2024, the amount of excess balances rose to 21% as the average ECR rose to 79 basis points (below). These higher excess balances are at risk of moving to higher yielding money market or business savings accounts.

To offset this risk, banks should consider increasing marketing to underscore the value of the analyzed checking account plus consider adding addition analyzed charges so accounts can utilize more the excess balances.

It is important to understand that analyzed checking can be positively convexed if managed correctly in a normal (non-pandemic and non-bank failure shock) economy. That is, as the economy gets stronger and interest rates go up, if a bank does not change its ECR or changes it just slightly, balances will go up, and profitability will increase. This is where you get superior performance.

Analyzed checking performance is likely better than interest checking accounts but not as good as non-interest checking accounts. Deposit product managers need to understand how each product reacts to changing rates and use upward rate changes sparingly.

Another takeaway is that the more valuable your analyzed checking account is, the less you have to worry about changing the ECR when the market moves rates and, likely, the more profitable the product will be.

Including positive pay is the classic example here. It is better to increase your monthly fee from $25 to $75 and include positive pay than not include it and charge separately for it. Charging separately for positive pay slows product adoption. Including positive pay not only reduces fraud and cost for both the bank and the customer but also makes the account less sensitive, allowing the bank to offer a lower ECR.

There is also the question of should credits, that is money coming into the bank that builds deposits, should be a charge? Traditionally, banks have included credit charge fees into analysis. While some customers may be sensitive to these charges and inhibit an account from using the bank for incoming wires, checks, ACH and instant payments, most customers are not sensitive. While this might be a battleground for the future, and every bank will be different depending on their customer base, however for the most part balance sensitivity to fee levels and inclusion are largely random.

5) Customer Segmentation

Here is the glaring issue in analyzed checking marketing and product management – we are offering a highly customizable product to the masses, thereby not taking full advantage of the product. The advantage of an analyzed account is that you can align revenue with costs and create an infinite amount of account packages customized for different types of customers.

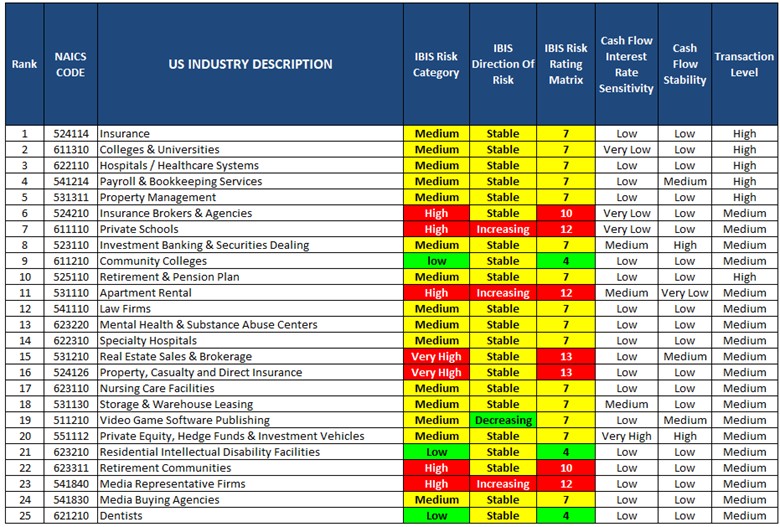

A customer with cash and currency needs is different from a growing manufacturing business, which is different from a payments-based business. As such, banks can offer customized account analysis packages to each industry. We detailed the most profitable treasury management customers and the most profitable treasury management attributes HERE. However, below is a table from that analysis that will help banks focus on what industries to focus on.

By changing transaction tiers, pricing, and the ECR, banks can better fit the industry they are trying to serve while lowering acquisition costs and increasing profitability. Analyzed checking pricing can and should be different for a payroll company or homeowners association than it is for a private college.

Here, banks should understand and identify segments that maintain higher balances versus those that frequently utilize balances to offset fees. The latter, to include high volume instant payment and ACH senders, will be more sensitive to being managed by an analyzed checking product. By tailoring the product banks can achieve greater margins while increasing customer satisfaction.

6) Marketing and Brand

Like other bank products, marketing and branding matters when it comes to product performance. A bank product exhibits different sensitivities when it comes to marketing at different times. Like companion products, a little marketing doesn’t impact profitability as it just appears that analyzed checking is another form of a bank account. However, if you can spend an above-average amount to break through the general background noise of marketing, marketing can also have an outsize difference in volume and profitability.

Bank marketing campaigns that take the time to explain the product from an industry segment point of view such as how analyzed checking helps medical professionals, educational organizations, non-profits, or law firms, will see an above average return on marketing investment.

7) Reserve Levels and Balance Adjustment Fees

Harking back to the pre-Dodd-Frank era prior to 2010, banks commonly passed through reserve balances that the bank was forced to keep at the Federal Reserve, earning zero interest. To this day, many banks exclude a portion of analyzed checking from either earnings credit or hard interest. Some banks, including many of the national banks, have evolved the reserve level concept into a “balance administration fee,” or “balance adjustment,” whereby the bank charges a fee per $1,000 in balances to offset additional FDIC insurance costs.

We dislike both tactics when it comes to building customer lifetime value. While we do not have any quantitative evidence for this, our position is that it hurts the bank’s brand by making a bank problem our customer’s problem. The customer is just looking to manage their liquidity and does not want to be concerned with reserve levels or FDIC charges.

It is common for banks to have a guide that is provided to their analyzed checking customers that says something like “How to Read Your Account Analysis Statement.” Something is wrong if you need eight pages to explain how to read a bank statement.

For the average bank, changing reserve requirements has little impact on volume changes.

Having reserve and balance adjustment charges in the account profile makes it seem like a bank “nickel and dimes” its customers or has “junk fees.” Removing a portion of deposit balances that are eligible for interest or charging fees on the level of balances complicates the understanding of the account and makes pricing opaque. Our advice is to build whatever fees you want into the account analysis, raising your monthly account fee or lowering your ECR to compensate for your desired profitability level without resorting to reserve balances or balance administration fees.

8) Rates on Companion Products

Banks will often do a great job with their analyzed checking account profile only to destroy value by offering a high money market account rate. A money market account is an alternative account to analyzed checking, and offering a high money market rate will serve to cannibalize, driving up a bank’s effective cost.

When it comes to companion products such as alternative transaction accounts, alternative treasury management packages, business savings, and money market, these make little difference until a certain threshold is reached, and then it makes a considerable difference. If your ECR is at 2% and you change your money market rate from 2% to 2.25%, not much happens to balances and the profitability of your analyzed checking account. However, change your money market rate from 2% to 4% without changing your ECR, and the value of your analyzed checking account and your bank will materially change.

9) Tiering and Deposit Beta of Analyzed Checking

We have discussed the strategy and tactics around tiering deposit accounts a number of times, notably how to tier (HERE) and what happens when you leverage machine learning to tier your accounts (HERE). The same lessons apply to analyzed checking save for one extra lesson. Because the effective rate of an ECR is lower than the stated rate to the bank, bankers tend to adjust an ECR rate along with Fed or market movement. It’s common, for example, to have the account’s higher tiers, say for deposits over one million dollars, to have a beta of one. Bankers often reason that they enjoy a lower effective cost of funds than their ECR and move their top tier for larger deposits higher. A high ECR may make customers happy, but it ends up not only increasing the effective rate of interest (via lower fee collection) but trains employees and customers to expect a beta of one. This not only erodes current profitability but also trains customers to be more rate-sensitive, hurting future performance.

10) Minimum Account Opening

While a minor element, some banks will open an analyzed checking account for as little as $50. Why? It takes a certain size and sophistication to be able to utilize an analyzed transaction account, so why not require a more substantial deposit to prevent account switching later?

The Future of Analyzed Checking

The rise of machine learning is just one of the many trends that will assist banks with managing analyzed checking. Machine learning tools will soon help automate pricing while providing a personalized offering that more precisely fits the customer’s needs.

The growing popularity of instant payments and the move to more modern cores are two major trends that are set to upend analyzed checking. Instant payments will increase the velocity of money, reduce fraud, and make cash flow more predictable. These trends will occur against a backdrop of falling costs, making analyzed checking more affordable.

Moving to a modern core, such as a Finxact and Thought Machines, will simplify the opening of additional bank products and services, making analyzed checking more valuable. The combination of instant payments and a modern core will allow banks to generate fees and balances off escrowed funds, allow for ubiquitous earned wage access, and automate contingent payments to name just a few.

Putting This Into Action

The banking industry is still figuring out how to quantitatively manage analyzed checking in this age of supervised machine learning. The lessons we presented today are for an average bank and may or may not pertain to your bank’s customer base, geography, or objectives. It is also important to note that this analysis was done using data from the current market. Should the Fed or market change the rate outlook, rate sensitivities are likely to move.

The ten lessons are just the starting point of concepts to follow and test in your market. The important point is to understand your customer base and your bank’s objectives while paying more attention to the data. Any rate changes your bank undertakes should be tracked by comparing volume and profitability before and after. From there, it is helpful to continuously tweak the product to try to optimize the offering.