Bank Strategy Using The Cube Framework

On our path to describing the Bank Strategy Cube framework, we laid down the four horizontal layers (HERE). In this article, we tackle the vertical layers that complete the cube. Where the horizontal layers pertain to strategy development at different parts of the Bank, the vertical layers provide the foundation for execution. These vertical layers contain the answers to the question of what customers to target, with what value proposition, in what segment or geography, and with what resources. If you are interested in a more effective bank strategy model, read on as this framework will give you an easy way to build strategy, block by block, across the organization.

Getting a Real Bank Strategy

Most banks, if you ask them about strategy, will tell you about providing a high level of service to their community. If you ask what business they are in, they would tell you that they exist to provide loans and to take deposits. Unfortunately, that answer serves as a limiting belief in truly developing a successful strategic plan. If your core mission is to provide a commodity product, then your business will be a commodity and will be subject to the winds of competition. However, if you want to differentiate yourself in the long run, then a true strategic plan is needed.

Reframe the question as “What business should we be in,” and then broaden your perspective and you might come to the conclusion that you are in banking to allow customers to experience financial growth. Loans, deposits, and other financial services are just ways to accomplish the goal of helping build financial freedom. This is where the cube comes in.

Using The Cube

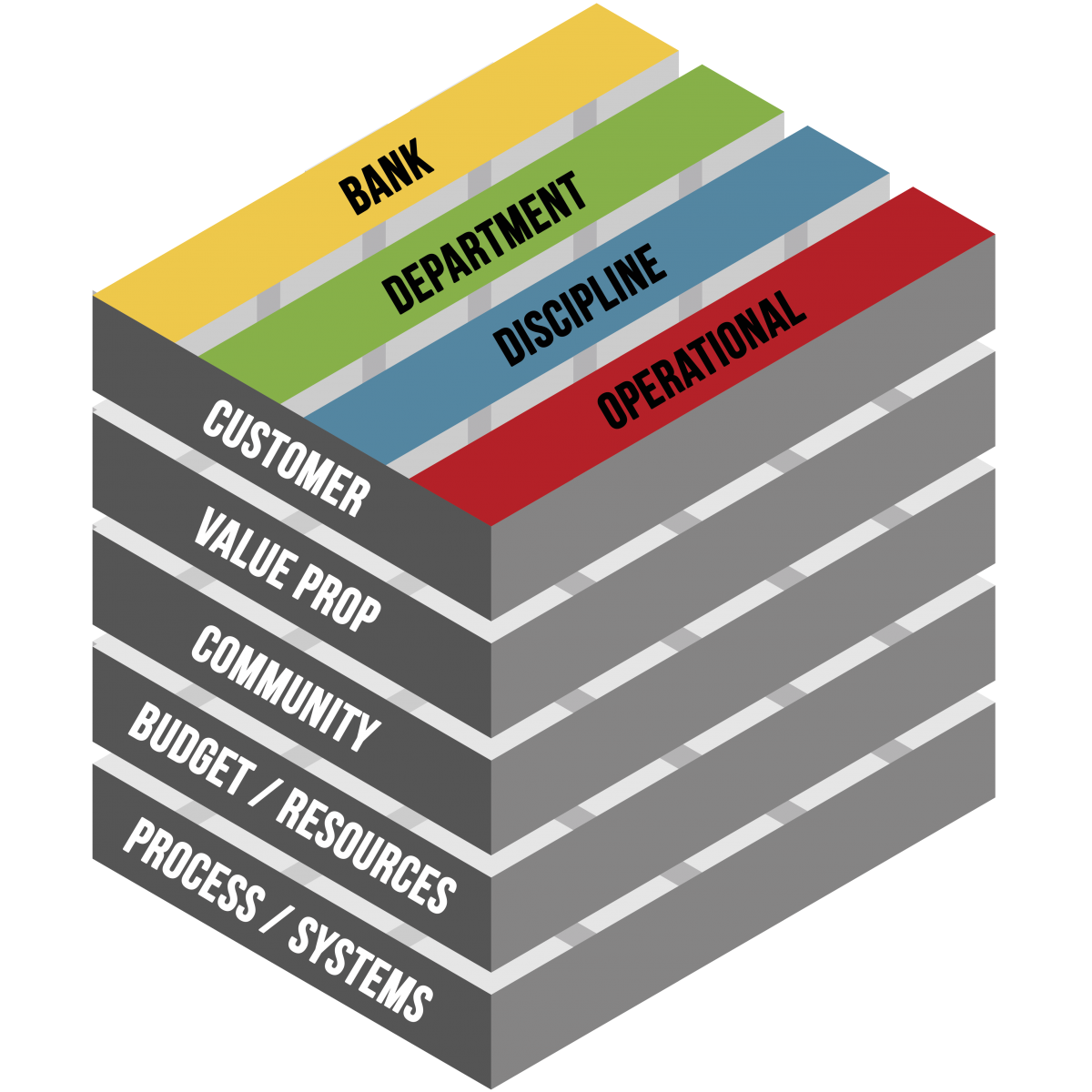

Once we understand the layers of strategy hierarchy – bank, department, discipline, and operational layers – we can now turn the cube on its side and look at each set of goals through a set of execution layers. These layers help create a strategy that truly sets the Bank apart. A graphic of the bank strategy cube is below:

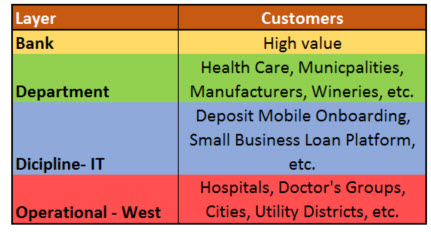

Customer Target: While the Bank has an overarching set of customer targets, each department may have a different set of target customers. The Bank may have a strategy to go after customer segments with above-average profitability and that are heavy users of bank products. For the Commercial Department layer, this might mean targeting health care providers while for the retail sector this might mean going after households with middle school children. The Discipline Layer for technology within the commercial department may articulate this initiative with their effort to develop further small business onboarding technology for deposit account opening while also rolling out a small business loan decisioning platform. At the Operational Layer, the customer focus gets articulated by going after subsets of high value, health care, and municipal customers that are material targets in their area. A bank may define this operational layer by branch, by region, or by business development officers.

Value Proposition: If there was one thing in your bank’s strategy to get right, it is determining where your bank can create value for your customer given the position of other alternatives. The value proposition for each layer may or may not be the same. For some banks, speed and ease of product use may be the main theme throughout the bank. However, for others, speed may be important for their commercial customer, but the value may be important for the retail department due to demographic factors. The key here is to define within each layer what the value proposition is of the bank, department, discipline, product, or community. There are a variety of ways to add value – speed, transparency, being a low-cost provider, being a high service provider, simplicity and the list goes on. Understanding the value proposition compared to competitors will drive each layer’s positioning in the market. Once determined, the byproduct will be a natural position in marketing, pricing, distribution, and community.

Community: Deciding where to focus is one of the most important strategic decisions that can be made as it is usually the factor that has the largest influence on financial performance. For most banks, this will be a geographical distinction when they define their community focus, however, for some, the community may be defined along different lines. For example, it is all the rage to focus on niche communities such as musicians, artists, or athletes. Your community could be around a product (e.g., SBA) or a very specific customer segment (f.e. country clubs across the US that are older than ten years old). In cases where the community is defined along customer segment lines, this layer can be collapsed with the Customer Target layer. An old adage in banking is that you become the profitability of your community. Focus on a profitable fast-growing community and chances are you will be a profitable fast-growing bank even if you have an average value proposition.

Budget/Resources: To execute a bank strategy, identifying the required resources that are needed to achieve the goal is mandatory. Initiatives often fail for lack of focus and formal resources. The most common mistake banks make is to assume you can layer on an initiative such as going after a new market in your spare time. Few bankers have spare time, and so an initiative such as this will get pushed off and likely fail. Identifying dollars, people, equipment, technology, or other assets will prepare all layers of the strategy cube for the effort. It is in this section where you should detail any capabilities or organizational changes that are required to execute.

Process/Systems: For smaller banks, the required processes and systems may be included in the above vertical layer, however, for most banks, it is helpful to break out the required systems needed. If your bank looks to strategically focus on high-value customers per our example above, having a relationship profitability model, a customer relationship management (CRM) system and a layer of artificial intelligence are now mandatory no matter what size your bank. While each initiative requires multiple systems, this section hones in on those systems or processes that are specifically required to support strategic execution. Revised back-office processes, customer-facing technology, faster credit decisioning, and similar are all examples of processes and systems that may be needed or changed to be successful in executing the bank’s initiatives.

Working Within A Cube

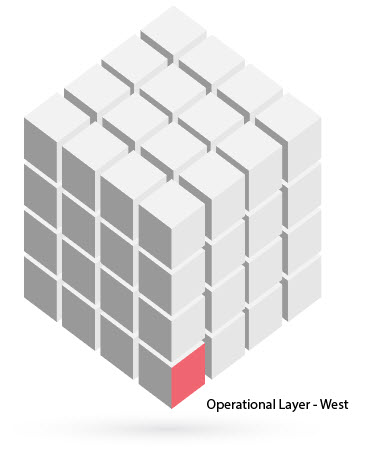

The cube methodology has the huge advantage of being able to segment out a sub-cube so that it can function independently and can be worked on in isolation. Security, for example, can come up with the basis of their plan without requiring, the technology group to complete their strategic plan. The Operational Group “West” may include several branches in the western part of the state that doesn’t have any tourism but is target-rich with health care. Here, they can customize their bank’s strategic plan for their particular area to increase the plan’s effectiveness.

Further, a bank may want to simplify or expand the layers on the cube to meet its needs. A small bank cube may contain a single operational section while a larger bank may have 55 geographic sections and 20 product sections within the operational layer. Conversely, for a small bank, if the value proposition is all the same for every layer, that vertical section can be collapsed in order to simplify the planning process.

Putting The Bank Strategy Cube Into Action

The bank strategy cube represents one of the most effective frameworks for developing a detailed and effective working strategic plan that can be easily updated each year. The cube framework is designed to break down silos while at the same time allowing each unit to operate autonomously if required. Each layer can be boiled down to a matrix filled with bullet points with very little narrative. This not only makes production easy but allows a cross-discipline view as functions like human resources or technology can now look up, down, and across the cube to see how they fit into the Bank’s overall plan. Finance, for instance, can simply sum the required budget from each layer and aggregate that into a starting budget. Human resources can do the same for staffing while IT can understand the support that it needs to give.

Bank strategy is an iterative process involving the entire organization’s stakeholders, including employees, customers, managers, board, vendors, regulators, and community. Working within a flexible framework such as a cube also allows different parts of the plan to be updated throughout the year. The end result is a dynamic framework and a more thought-out strategy that not only makes a difference but brings the bank together into a single cohesive unit – it will just be in the form of a cube.