1:1 AI-Driven Marketing Based on Customer Intent – Part 2

Last week, we covered the first two steps in using AI-driven marketing data to uncover the customer’s intent. (HERE). This week, we discuss the last two steps and show how generative AI is the new major change in bank marketing when it comes to becoming much more effective at leveraging customer intent.

Interpreting topic models has always required a certain level of AI expertise which was often outside the reaches of banks and even advertising agencies. Gen AI can now act as an “interpreter” helping bank marketers’ piece together insights from the topics banks are interested in. In Part I, we showed how we can use some off-the-shelf tools or basic Python coding language to use our marketing data to group topics together and chart their relationship. We will now use gen AI to go back into the topics to derive insights.

Step Three: Using Gen AI

We then take the keyword strings plus the related content each customer has clicked on, and feed that into a gen AI model. We have the data around not only where the customer clicked on our webpage, but how long they stayed, and what products they were researching before and after. This string can be one or twenty topics long. AI can reduce this string to a minimum number of topics that result in a clear intent by the customer. Usually this is a string of three to four topics.

For example, we know we have a topic cluster around construction lending, Trump Administration, interest rate risk and cost of capital. This is slightly different than a string that is “construction lending_Trump Administration_managing draws_interest rate risk.” Based on past actions, the former string denotes an intent around being concerned with long-term financing while the second string is more concerned with cash flow management.

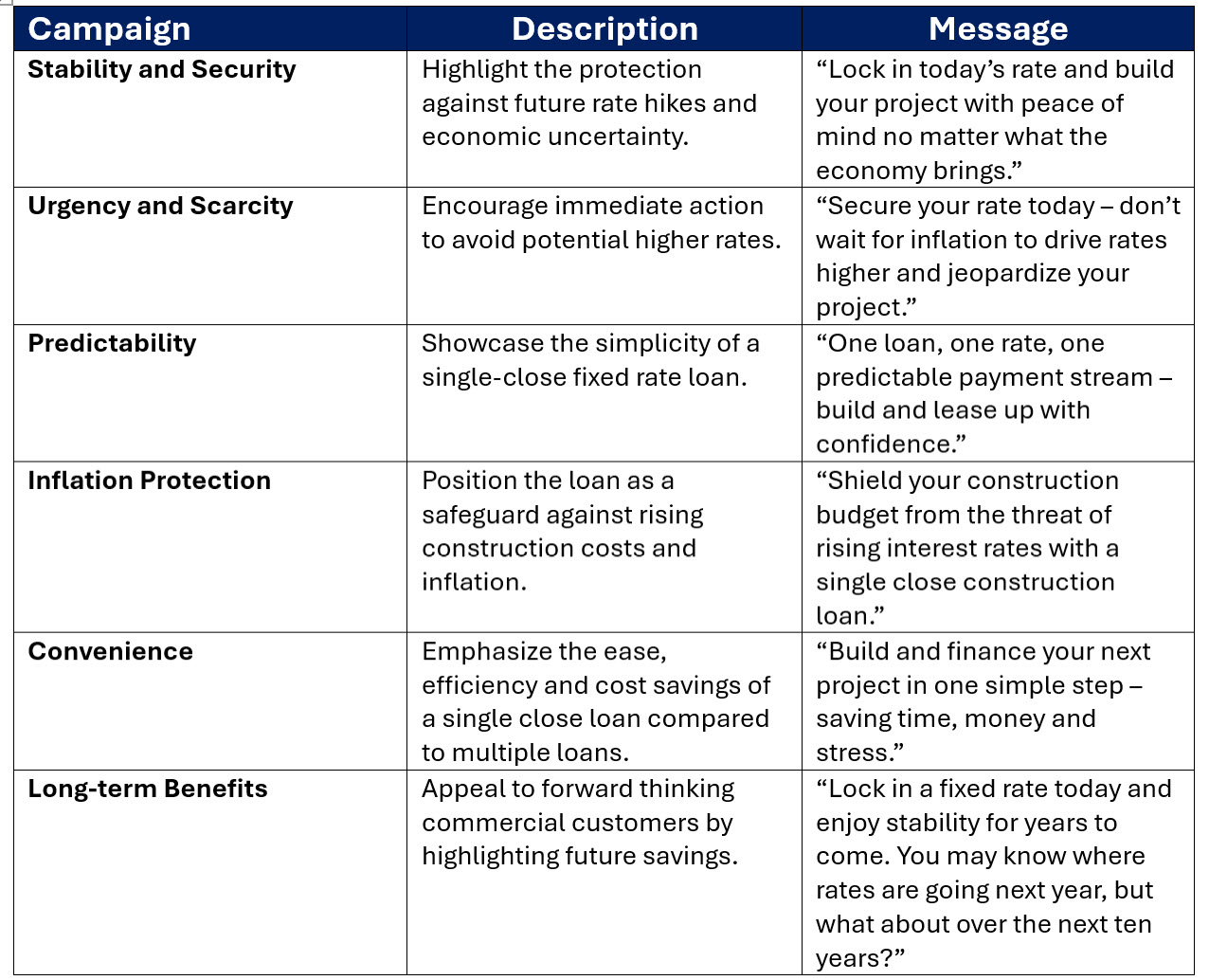

Gen AI is fed a prompt that creates a concise journey label such “Construction to fixed rate term concern” for the former intent path or “Rising interest rate draw concern” for the later intent path. The prompt also creates a two-sentence journey description so we can know more about the journey, and we ask the model to generate a specific campaign using wording that elicits a call to action based on behavioral psychology.

Feeding the content the customer has consumed into a gen AI engine such as Gemini or ChatGPT, we can have gen AI summarize this journey. For example, the first customer is concerned about interest rate volatility with the next Trump Administration and its impact during the construction period of a commercial real estate loan.

We then ask the gen AI model to generate a message based on the data above. The model correctly deduces that because of the intent and journey, the customer is concerned with certainty, stability and protection. More interestingly, the model looks at the period the customer consumed the information and deduces there is a sense of urgency since the customers consumed data over a short period of time using the bank’s search capabilities and not as it was produced.

This is one of the true advantages of AI. The insight here is that AI can analyze not just the content, but the path the customer took to get to the content, plus the meta data around the content such as the time it takes to consume that content. A customer that searches for content and clicks around multiple places on a website, usually has a specific intent in mind and a greater sense of urgency than another customer that follows the same path but takes the content journey over a longer period.

Gen AI also understands that a customer with that specific intent has a set of behavioral psychological triggers such as aversion to loss, the need for social proof, customer control during uncertain times, and the need to move sooner rather than later.

Gen AI creates a set of keywords to use in messages that psychologically align to the projected action of each intent.

AI then creates a campaign based on each customer intent. Not only that, but each customer with the same intent may also be motivated by something slightly different. Some customers might be motivated by safety, some by fear of missing out and others by convenience. Gen AI looks at the machine learned data and creates six different campaigns.

Step Four: Creating the Workflow with Agentic AI

Any good AI strategy outlines the elements of the data, the model, the governance and the workflow around the model. Here, we pull the data, create the insight, generate the output – now we need to ensure we have the workflow to turn the insight into action.

The campaign can be generated manually by inputting the campaign elements into any given marketing application such as Hubspot, Salesforce or other marketing platform, or you can leverage an intelligent agent and create the model within the platform or in another marketing platform.

However, the rise of agentic AI can now help banks take it a step further. Platforms like Salesforce can now take the data, the campaign and the governance monitoring and combine it with workflow. It takes the data from the CRM system, generates a marketing campaign for one customer and then connects with the marketing application of Salesforce (called Marketing Cloud).

Gen AI combined with these agents can then expertly focus each campaign into a customer’s preferred marketing channel based on how they have responded in the past. This might be an in-app message, email, social media post or even a call from their relationship manager.

When the algorithm is unsure, it may automatically send a clarifying SMS message to the customer such as, “We see you were looking for information about a construction loan. Were you more concerned with convivence or inflation protection?” The agent not only looks for a response but measures how long the customer takes to respond and if the customer ask further questions. The AI agent has the ability to converse, and not only record the information, but also record the meta data (such as the time it took the customer to respond) and the sentiment the customer had. This data further helps craft the message.

The Result

The result is this highly personalized marketing effort on a scale that is better than what an experienced human can do. As more and more information is learned about the customer, the message is further refined and potentially expanded to include other approaches, products or information to engage the customer and increase the relevancy of the bank.

The New Role of Bank Marketing

As you work with AI, you realize the shift that is taking place in bank marketing. The bank marketer’s job is to no longer create campaigns, content and graphics, but to manage the agent that does that. The bank marketer must create the environment for which the AI agent to operate in.

Since data derived from the content, bank marketers need to have an efficient content strategy that is more than engagement. A modern content strategy must both engage and be diverse enough to be able to deduce intent. The bank marketer must then provide the various marketing channels for the AI agent to operate on so that it can deliver the right message at the right time in the right format.

If done correctly, the bank marketer can see not only a material lift in effort, but this lift can be harvested at scale. Instead of running 20 campaigns a year, bank marketers will run thousands of campaigns per year.

AI for Deposits

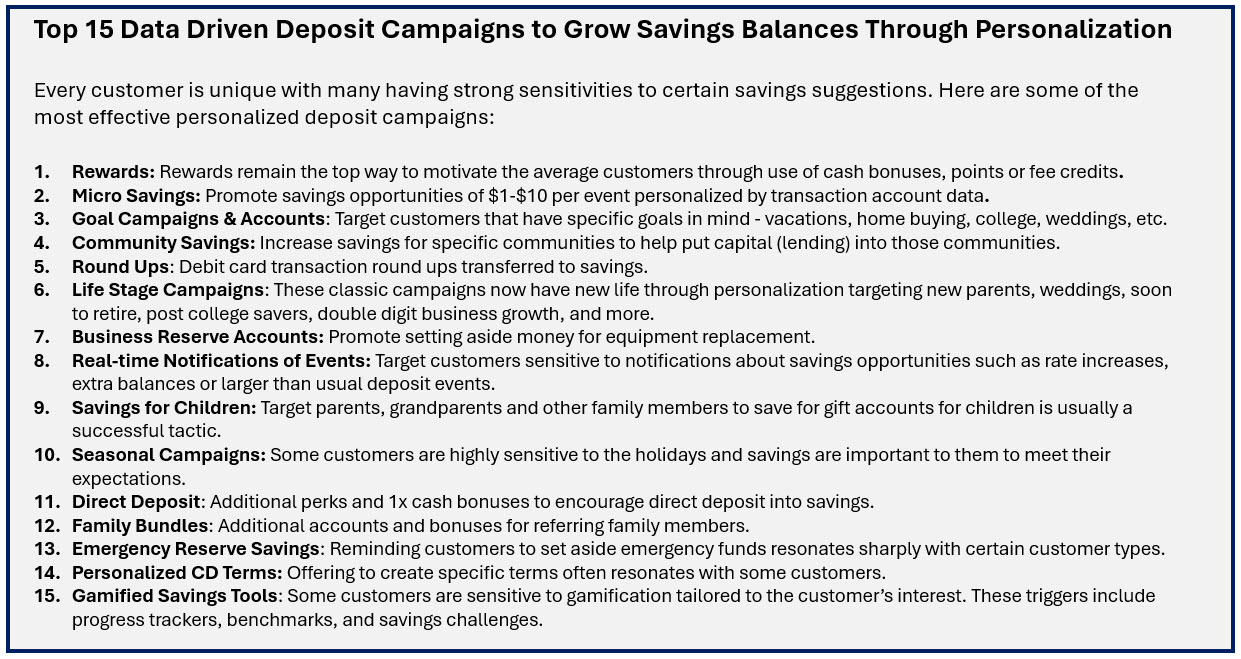

While this marketing approach around customer intent is interesting for loans, the large value driver is for banks that can harvest this methodology to drive deposits. Below we provided some of the most effective campaigns for growing savings deposits. Banks can develop tactical plans around those campaigns that resonate with their customer base and objectives. Banks can use this list to develop content to enhance their websites and integrate interactive tools to decipher the intent of the customer.

AI for Enterprise Marketing

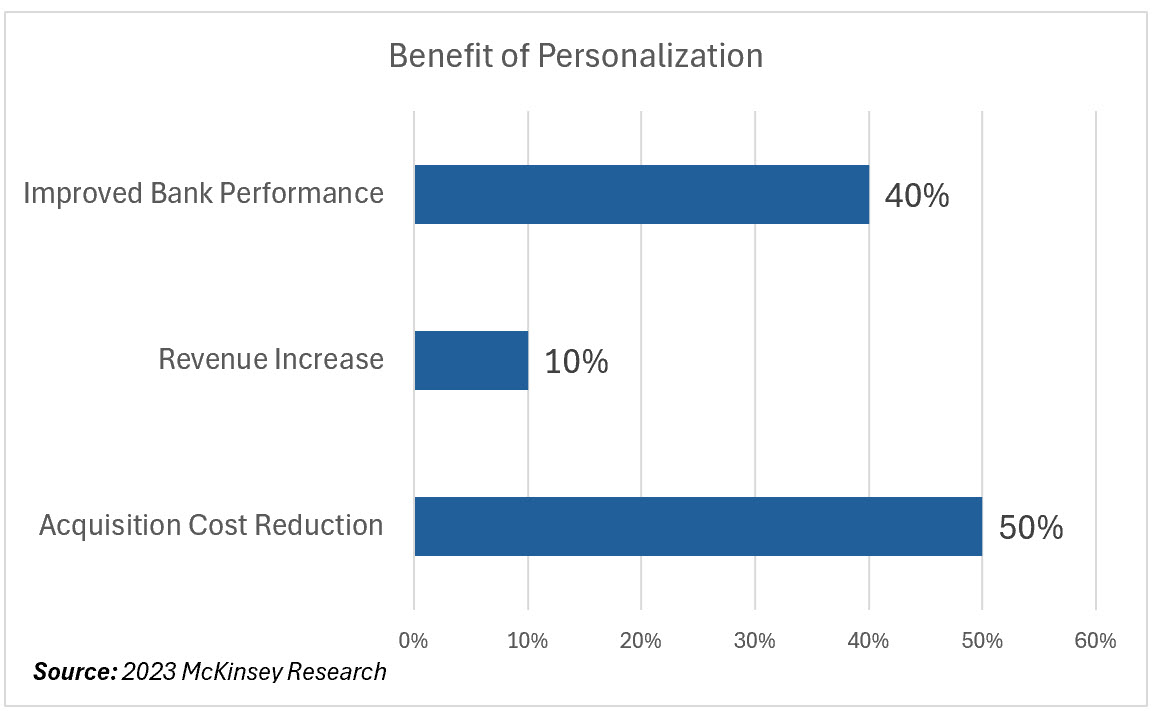

Of course, leveraging AI to discover intent in marketing can help with a whole range of efforts within a bank to include recruiting, employee engagement, training and vendor management. A recent McKinsey study found the benefits of personalization can lift bank performance by 40%, add 10% to revenue while speeding customer acquisition and reducing cost.

In this article we showed you a simple way to leverage inexpensive tools to help provide improved performance by discovering customer intent and then using generative AI to formulate highly personalized campaigns. Banks that embrace this technology sooner will see the largest lift compared to other banks that are still using demographic data or mass marketing. The age of treating all customers and prospects the same is about to disappear. The future is to leverage data, traditional AI and generative AI to outperform.