10 Data-Driven Ideas To Increase Branch Engagement

It is a dangerous troupe in banking that an omnichannel approach is best. The concept that we allow the customer to choose how they want to bank often enables the bank to be passive in its position and give up agency. Branching, for example, is too expensive to be all things to all people. In this article, we look at cell phone tracking data for about 1,000 branches across the industry to derive insights to help banks increase branch engagement and boost branch profitability.

Branching is likely your bank’s highest functional cost, just ahead of loan production. At around $75 per year for unique visitors, it’s multiple times more expensive to service customers compared to other alternatives such as online, mobile, or phone. That said, branch profitability has come roaring back, given the value of deposits. What used to take $160 million in deposits to break even back in early 2021 now takes closer to $40 million. Despite that increase in profitability, banks need to be mindful of how they manage their branch and customer base to increase profitability further.

The operative question is: given online and mobile banking, what is the new role of the branch? Often you hear the refrain – our customers want a branch because we make them like a branch. Certain transactions and many problems can only be solved in the branch. This fact, however, is rapidly changing. The advent of generative artificial intelligence is about to shift branch strategy again to re-raise the question – how can we get the most out of our branches?

The industry has been asking this question for over a decade with few good answers. While we have discussed branch profitability modeling (HERE) and branch strategy post-pandemic (HERE and HERE), in this article, we go deeper into the data to improve branch engagement and performance no matter your strategy.

Below are ten ideas, driven by data, that are not so obvious when looking to increase branch engagement:

Ten: Have a Strategy Centered Around In-Person Branch Engagement

This should go without saying, but many banks still need a clearly stated intention for their branch channel. Branching is expensive – banks need to use the asset wisely. At an average of $1 million per year to operate, the branch is the most expensive per unit channel in banking, given that a good branch serves 2,000 to 3,000 customers. As such, banks should use the branch purposefully, leveraging a specific strategy built around human interaction.

For some banks, their strategy will focus on face-to-face selling and service. For other banks, the primary strategy is to enable mobile banking penetration and engagement further. For others, it might be fixing problems, aiding in retention, increasing customer satisfaction, gathering customer intelligence, or providing a meeting place for face-to-face interaction for events. Likely, it might be a combination of the above, but setting a branching strategy should dictate capital allocation, branch layout, marketing, and staffing.

Our point here is branching isn’t a passive activity. Strategy drives tactics, and tactics can drive success. Banks should have a clear and stated set of measurable objectives for their branches and then allocate capital accordingly.

Nine: Feature Your People

Bankers intuitively know the value of people, yet few banks build a strategy around their people. Use the power of your people to attract customers, and then use the power of the bank to keep customers.

The reality is that no customer wants a branch; they want an in-person banker. If you want to make your branch marketing almost twice as effective, use your marketing dollars to highlight the people in the branch. Take the time and effort to explain the backgrounds of the bankers, both personal and professional, and invite the community to establish a relationship. The more personal and closer to the mass private banking model you can get, the more influential the campaign will be. Customer anxiety around branch banking starts and stops with the customer not knowing how to solve their challenge. Giving them an accountable banker will go far in tying that customer to the bank and the branch.

Make sure the bulk of your advertising features the introduction of personnel that can solve specific problems, like the Instagram advertisement below.

Eight: Target Time-in-branch To Improve Traffic Flow

The average branch transaction should take less than 15 minutes to accomplish their banking business. The more efficient you make the branch, the higher probability that both profitability and satisfaction will increase.

Unfortunately, the average time-in-branch is 30 or more minutes. Account opening, for example, should take less than five minutes and, unfortunately, takes 45 minutes at many banks. Customers with more extended visits to branches are likely to be frustrated and open to switching branches. Given the current ease of access to data, banks can now target these customers and serve them ads using potentially slow service as a catalyst to move banks. Banks can get near-real-time data of customers that recently spent more than 40 minutes in a branch or can target the customer of competitors that have longer wait times due to outdated technology or are understaffed.

Later, we will discuss increasing time-in-branch using other engagement strategies, but these should be optional. Every branch’s goal is to completely satisfy the customer’s primary needs in the shortest amount of time. Then, additional time can be spent on education, engagement, and entertainment around an experience.

Seven: Proximity Marketing

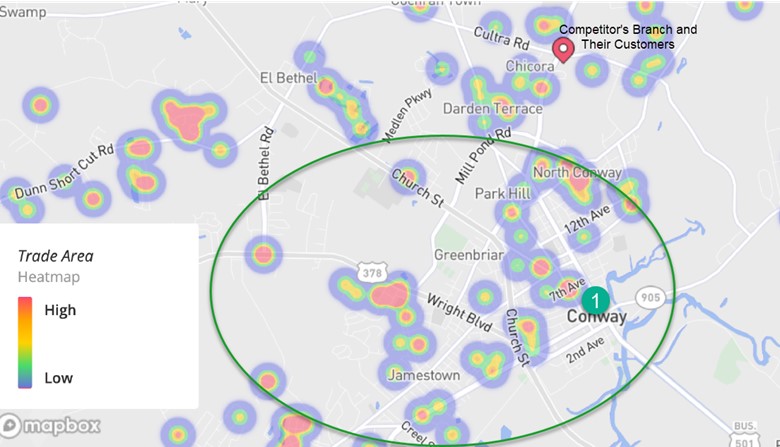

The convenience of location remains one of the top factors that customers use when choosing a bank. 85% of customers want their branch to be close to their home or workplace. Through modern data tools, banks can now map their competitors’ customers closer to their bank’s branch than their competitors (below). Here, a convenience pitch may resonate with customers that could save time by switching banks.

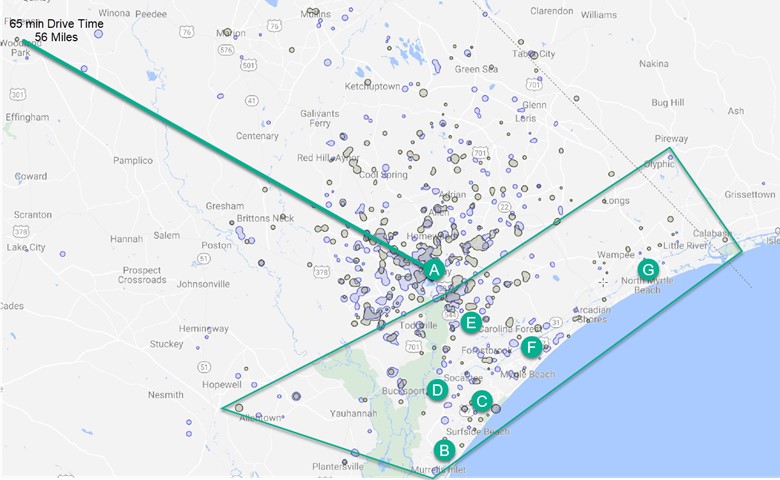

Alternatively, banks can map their own customers to optimize their customer’s time and increase retention. Below, we mapped all the customers to a branch at “A.” We can see that 75% of the customers fall within a five-mile radius of the branch, and 90% are within 12 miles. This is about a normal modern branch footprint. However, it can be further optimized.

For starters, some customers come over 50 miles to the branch. It would be essential to see what draws these customers in and how the bank can better serve their needs through digital channels. Further, there are a large array of customers where branches B-G are closer to their work or home location. A bank may want to consider suggesting and providing an incentive for the customer to move branches in order to be better served.

Six: Use the Data

A bank should know the purpose and reason for every customer entering the branch. While the branch likely tracks transactions, it may not track non-transactional activities (such as inquiries) or track transactions per visit in cases where a customer accomplishes multiple transactions.

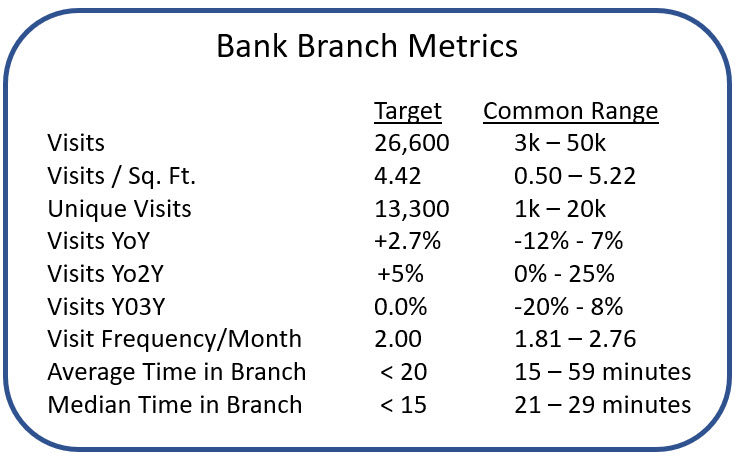

This data, and general high-level metrics like the ones below, are critical to determining the true nature of branch usage and cost. Further, depending on a bank’s strategy and objectives, a bank will likely want another panel of metrics to include a Net Promoter Score, average lifetime value, transaction value, average deposit balance, or any other metric that branch management can focus on.

Five: Last Mile Digital Conversions

One of the more successful uses of modern branch strategy is to move non-mobile banking customers onto your bank’s mobile platform. The average community bank may have 30% to 50% on mobile, while the national banks are closer to 80%. Chase is a leader in using their branches to ensure branch staff enables every customer, to the extent possible, to handle their business on their mobile platform.

For example, when a customer walks into a branch to send a wire, Chase staff ensures they can log in and know how to navigate and then helps them send a wire on mobile. Staff can follow up with a “How to Guide” that details how to send a wire via mobile to remind the customer next time. Do this enough times, and mobile penetration skyrockets, reducing the need for the branch in the future. Banks can then close branches in the future as high mobile usage make it more likely to retain customers while providing support for regulatory review.

Four: Get Your Staffing Right

Since before the pandemic, staffing levels and structures haven’t changed for many banks. With work-from-home rates continuing to be high, travel patterns and the timing of when customers go to a branch have changed.

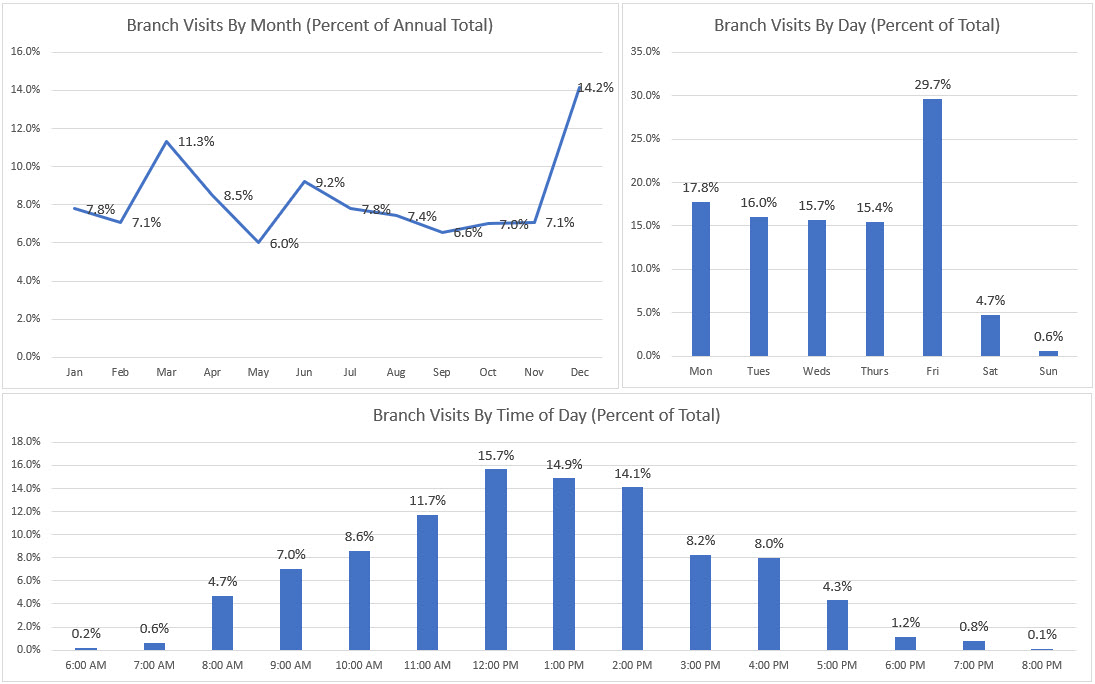

Many banks have modeled their branch staffing to the traditional traffic flow model that still holds true today. The below data, for example, is from last month and isn’t all that different from traffic patterns ten years ago.

However, what is different is the dispersion of traffic patterns now. If you look at a single branch, there are significant discrepancies in data. Some branches, for example, now have more traffic on Tuesday and less on Friday. Many branches have seen a decrease in traffic on Saturdays.

Regarding branch traffic, the smaller the customer base, the more evenly distributed traffic tends to be. Thus, staffing becomes more even once you serve under six thousand unique customers. However, more Monday and Friday staffing is often needed as you grow.

Branch engagement starts with the right level of staffing. Using cell phone and in-branch data, banks can utilize scheduling applications, interactive tellers (ITMs), phone support, smart safes, more carrier services, pre-staged transaction lockers, or flexible staffing to optimize their service level. These methods allow staffing levels to be reduced and/or changed for a greater service level.

Three: Understand the Journey

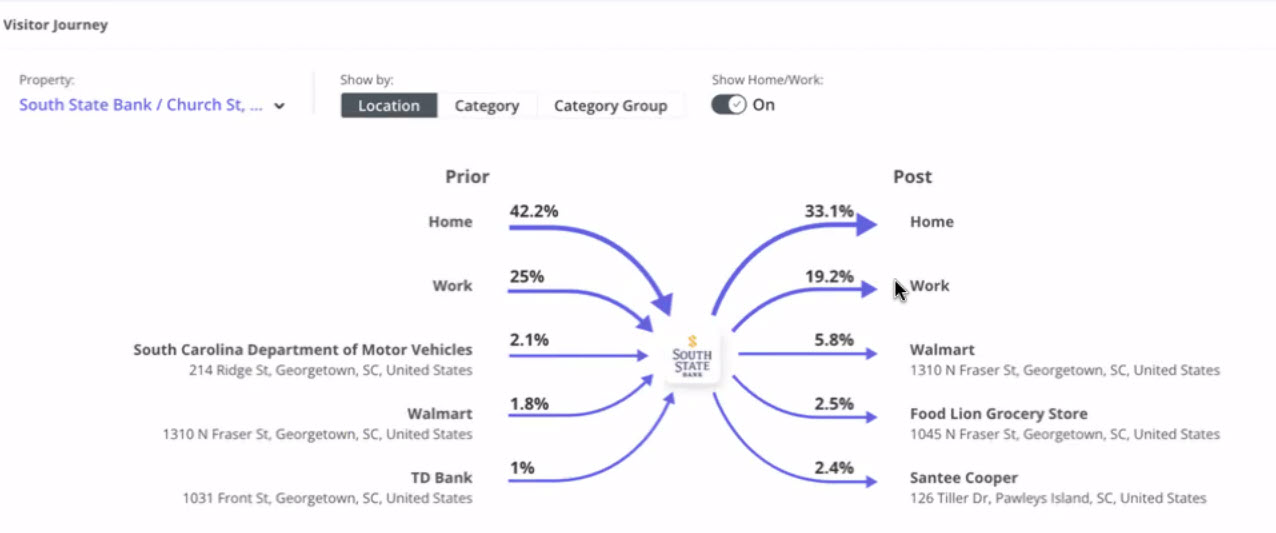

If you track the customer journey before and after the branch, what you find is data like the one below. Post-pandemic, almost 45% of customers are at home before visiting a branch, while 25% come from work. Conversely, about 35% return home after the branch while 19% return to work. From this data, combined with the data above, banks can better target customers to make the branch more effective.

A customer coming and returning from home is more likely to have some flexibility. Here, banks can proactively market and reach out about scheduling to shift traffic. More importantly, this data forms the basis of a drill down to understand better what those customers coming from home are doing. Interviews or additional data collection may uncover the percentage of customers that come to the branch for their home mortgage, make deposits, withdraw funds, conduct business banking, or inquire about other products.

In addition to home and work traffic, retail destinations are also popular. If there is a Walmart near a branch, chances are a material amount of a bank’s traffic comes from or goes to that retailer. Grocery shopping and malls/retail centers are often common post-branch destinations. Below, we charted the next post-branch visit destination to uncover where our competitor’s customers are going.

Using this data, we can work on mobile messages, branch promotions, and/or partnerships around these destinations to support branch engagement. For example, a bank might want to target a savings account that provides an upfront or annual credit at any store in a popular retail center destination. Using this data combined with a personalized marketing campaign would have a higher open, click, and conversion rate compared to just marketing a savings account alone.

Our point is that banks can better view their customer’s journey and intent by leveraging traffic data. This data can make marketing and branch delivery more effective.

Two: Square Footage Matters

When building or acquiring a branch, traffic data provides deep insight. Most banks have too much square footage for their potential traffic patterns. To the extent you influence branch square footage, it is vital to understand the customer journey and the branch’s strategy.

To the extent you need to have a mortgage, wealth, and small business specialist in the branch, that would lead to a larger footprint of 6,000 or more square feet. However, for a branch that is largely retail-focused, 4,000 square feet appears to be optimum if the goal is to maximize transactions or visits per cost-to-operate. Whatever the case, data purchasing allows you to buy information about the size and traffic of any competitor’s branch, plus highlight traffic areas around the branch from which you can potentially draw. This allows banks to not only correctly size their branch but help set strategies based on available traffic and psychographic profiles of an area.

Banks that already have excessive square footage that is underutilized may want to consider partnerships to create a multipurpose destination. Tax, accounting, phone repair, shared office space, coffee, and food spots have all been successfully tried to increase branch traffic like HomeTown Bank (MN) below. Co-locating another business within a location is likely to jump branch engagement.

One: Visit Frequency and Engagement

Some banks use the metric of visit frequency as a major driver. Here, banks need to be careful about why customers are using the branch, but if it is for items that cannot be more efficiently done via mobile, then it is likely a worthy goal. Sales consultations, problem-solving, education, and planning, are all fantastic reasons for in-person meetings. In terms of setting strategy, banks should find innovative ways to increase these valuable in-person interactions.

More in-person interactions could be in the form of more in-branch speaking events, workshops on various educational topics, or product specialists that visit. Other ideas include creating an Instagram-friendly wall (below), holding in-branch classes (some banks do a small business educational series), live animals for adopt a pet promotion, giveaways tied to pop culture (i.e., Succession t-shirts), special in-branch discounts, or any of the hundred other ideas that create an experience worthy of a trip in.

Barnes and Noble has book signings and Saturday Storytime, Home Depot has its DIY Clinics and plenty of retail stores conduct in-store charitable fundraising to support the community (example HERE); banks can do the same. The goal is to create energy and engagement.

At a minimum, driving branch traffic engagement should have a separate line item. If it doesn’t, then it’s worth a management discussion over if you should have fewer branches.

An active social media campaign leveraging community influencers has never failed to promote a bank’s brand and serve to increase branch traffic. Using social media and the press to amplify some marketing efforts should be a quarterly activity for all regions.

Putting This into Action

Managing branch traffic and staffing are not passive exercises. Banks can profoundly influence how and when the branch is used and should consider being more purposeful in driving branch engagement. Every bank should have a branch strategy and a clear set of metrics to judge success. Branches are no longer needed to gather deposits or to conduct transactions, so the question is, what is a branch good for? While there are many good answers, the goal is to find the correct solution for your bank.

Banks must continually revisit branch assumptions and capital allocation to ensure the branch is a proactive contributor to ROE. Many banks succeed with their branch network despite themselves.

Modern branch management is built around choosing strategy and tactics and then creating an experience around a clear and measurable set of objectives. Then, it is about using data, marketing, and sales to achieve those objectives.

The power of data to drive bank branch profitability cannot be underestimated. Leveraging data effectively can illuminate valuable insights into customer behavior, preferences, and needs, which in turn can be harnessed to enhance engagement, attract more traffic, and ultimately increase the bottom line. As we journey into the future of banking, a dynamic, data-driven approach is not just an option but a necessity. It’s about creating a more personalized, seamless banking experience that meets customers where they are and anticipates their needs. Banks that harness the power of data and use it to guide strategic decisions, both at the individual branch level and company-wide, will be well-positioned to thrive in an increasingly competitive landscape.