Fixing Loan Selection Bias In Banking

At this point in the business cycle, we believe that community banks should migrate to higher credit quality loans. However, in response to our last few blogs, some community bankers told us they have few opportunities to originate loans at 1.75X debt service coverage ratio (DSCR) and sub 60% loan-to-value (LTV). We believe that the issue some community banks face is survivorship bias, which can be easily remedied.

Loan Selection Background

Because the Fed is bursting the everything-bubble and raising interest rates in response to unwanted inflation, we believe that banks should be prepared for heightened interest rate, credit, and liquidity risks. Banks must identify opportunities to book higher cash flow and lower LTV loans priced accordingly. With interest rates rising, real estate cap rates near historically low levels, and long amortization periods, banks must protect their balance sheet with stronger credits.

What Is Survivorship Bias

Survivorship bias is the logical error of concentrating on outcomes that made it past some selection process and overlooking outcomes that do not make the selection process. Because of the lack of visibility, false conclusions are drawn.

Example of Survivorship Bias

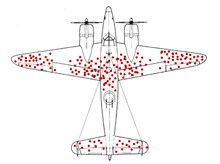

In World War II, American statisticians were tasked with how to make our planes less likely to get shot down by enemy fighters. At that time, the available tool was to install armor on a fighter plane. But the armor makes the plane heavier, and heavier planes are slower, less maneuverable, and use more fuel. There is an optimal amount of armor for plans. The question is, where and how much armor should the military install on planes?

The military supplied the scientists with data on the number and pattern of bullet holes on planes returning from engagements. The damage was not uniformly distributed across the aircraft. There were more bullet holes in the fuselage and wings and fewer bullet holes per square inch on the engine.

The officers in the military started installing armor on the places with the greatest need – where bullets were most pervasive (fuselage and wings). But the statisticians disagreed. The statisticians concluded that the armor must not go where the bullet holes are but where the bullet holes are not: on the engines. The statisticians proved that the planes that were coming back with fewer hits to the engine were the ones that survived and that the planes that got hit in the engine were not coming back for the military to observe. The aircraft returning to base with bullet holes in the fuselage and wings were strong evidence that hits to the fuselage and wings can (and therefore should) be tolerated.

Loan Selection Bias in Banking

A similar phenomenon is now occurring in banking. After approximately 14 years of searching for yield, banks have excluded many lower-yielding loans from their selection criteria. It is the lower-yielding loans that demonstrate higher cash flow coverage and lower LTVs.

The problem for many banks is that the general performance of all loans is measured quarterly on financial statements, but the return on equity (ROE) of individual loans going into the portfolio is not measured at inception or through the life of that specific credit. The loans that might garner a bank a higher ROE during a rising interest rate and decreased liquidity environment are not in the selection process because lenders have been conditioned to optimize loan yield. Many banks only measure loan yield in their selection process. Paradoxically some banks have minimum loan yield or loan spread criteria – it is not surprising that lenders will not present loan committees with opportunities to observe higher credit quality but lower-yielding loans.

Banks using the ARC loan hedging program reserve the platform for better credits. In this program, we observe community banks’ opportunities to book better credit quality. In the ARC program, we have identified that the most critical factor driving long-term loan ROE is credit quality and not yield.

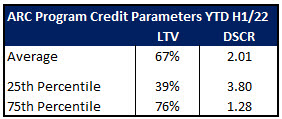

Higher credit quality loans will generate a lower yield. However, loans booked today will need to withstand the strain on cash flow, the impact of inflation and higher interest rates, an increase in real estate cap rates, and a decrease in collateral values. The average and quartile values of DSCR and LTV for the ARC program in H1’22 are shown in the table below.

It is important to note that while the average ARC loan in H1’22 showed a high DSCR and low LTV, the upper quartile of DSCR and LTV were especially strong. This indicates that the market presents ample opportunity for community banks to book loans with substantial credit safeguards. However, these lower-yielding yet highly profitable loans will never make it to loan committees if the only criteria is yield, or if lenders are beholden to minimum credit spreads.

Conclusion

The risk facing bankers is not always straightforward and easy to solve. But in the current business environment, with high inflation and expected rising interest rates, decreased liquidity, and increased credit risk, bankers should be able to avoid survivorship bias and book loans that impact what matters – long-term ROE during a challenging economic cycle.