How Your Bank Can Compete Against Fannie and Freddie

Both the Federal National Mortgage Association (Fannie) and the Federal Home Loan Mortgage Corporation (Freddie) have aggressive multifamily lending programs and comprise the bulk of the market. Freddie’s total multifamily finance activity in Q1/21 was $14B, and Fannie Mae’s was $21.5B. Some bankers complain that taxpayers’ dollars are creating an unfair playing field for financing that can be efficiently handled by thousands of banks throughout the country. This is true. However, by correctly positioning and differentiating their services, community banks can win a good share of profitable multifamily loans. We recently competed against Fannie on a small multifamily loan refinancing. Here is how community banks can beat the competition.

Quoting

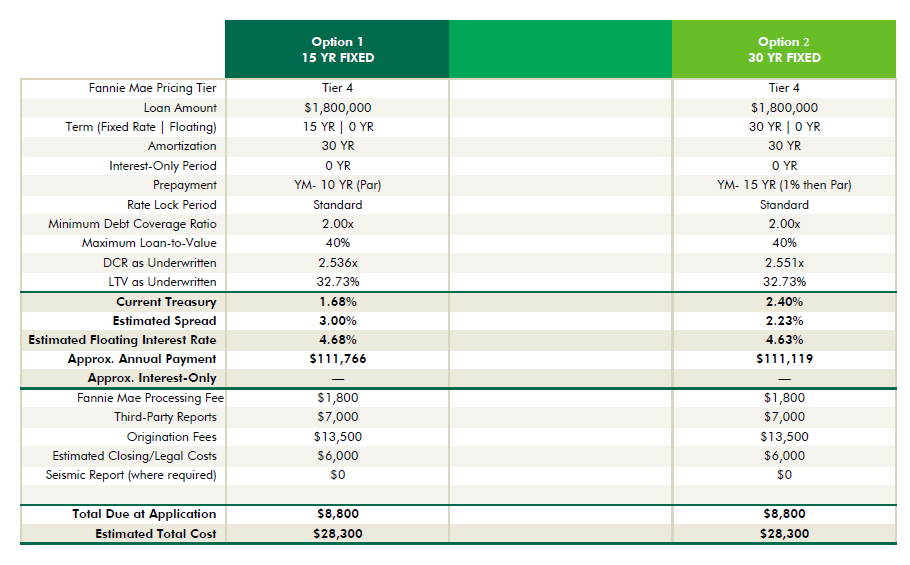

Below is a table outlining the quote from Fannie.

How Our Bank Responded

Term

Fannie is offering 15-year and 30-year fixed rates. Interestingly, the credit spread from Fannie was lower on the 30-year fixed, but that aligns with our risk-adjusted return on capital (RAROC) modeling that shows longer-term loans are more profitable. Our community bank was willing to offer 10, 15, or 20-year fixed-rate using our hedge program (called “ARC”) that is also available to all community banks. We start by positioning our available maturities (up to 20 years) against Fannie’s 30-year maturity by explaining that most borrowers do not hold the loan for 30 years without a cash-out or other amendment. Therefore, the borrower would pay for term that they may not use if they went for the 30-year option.

Credit Spread

Generally, credit spreads we see from Fannie are in line with the market for the multifamily category. However, this loan is 40% LTV, and 2.5X DSCR, and the 2.23% and 3.00% spread prices well in our RAROC model at over 20% ROE. However, our bank was able to obtain premium pricing on this loan because of how the lender positioned the bank (read below). Two important explanations on the lower spread that Fannie quoted for the 30-year term: First, while the index quoted to the borrower is Treasuries, Fannie’s cost of funding is the swap curve, and currently, the 30-year swap rate is lower than the 30-year treasury rate, so the effective spread over the swap rate on the 30-year term is 2.79%, not the 2.23% stated on the quote sheet. Second, even after adjusting for the swap curve, the 30-year term spread is still about 20bps lower than the 15-year term, and RAROC explains this – the longer loan is more profitable and can be priced tighter. Community banks should have the same RAROC calculation at their disposal such as our Loan Command Relationship Profitability Model when pricing such credits (also available to all banks).

Prepayment Provision

Depending on the program and the offering, prepayment provisions offered by Fannie can be prohibitive. In this quote, the yield maintenance provision is lopsided to the borrower’s disadvantage and locks the borrower into the facility without an opportunity for refinancing. Our community bank offered a symmetrical prepayment that allows the borrower to capture a fee if interest rates should rise, but the borrower must pay a fee if interest rates should fall. Since the borrower is expecting rising rates in the medium and long term, this was a powerful selling feature.

Closing Costs

Fannie was estimating over $28k in closing costs or 1.6% of the loan amount. Our community bank was able to save the borrower almost $22k in closing costs. However, the community bank generated $44k in ARC hedge fee income that was recognized immediately in income, increasing the ROE on the loan substantially. When the industry is punishing NIM-centric business models identifying a source of fee income is crucial for survival.

Flexibility

Fannie and Freddie’s programs have substantial criteria and minimum requirements for their various programs. The programs also have loan size minimums, location requirements, minimum and maximum unit requirements, and restrictions on junior liens. The underwriting and funding may take a long time (typically several months), and terms and conditions are not assured until the day of funding. The borrower should not expect a relationship with Fannie for any future servicing needs.

This is where community banks can differentiate their services by highlighting their flexibility in being able to structure a more tailored borrowing solution and being able to accommodate unexpected borrower needs such as collateral substitution, prepayment options, assignments, subordinated debt, and cash-out requests. There is value in every product that convinces customers to pay a premium – that is the value that your bank must demonstrate to the borrower to win this loan business.

Our banker pointed out to the customer the substantial flexibility in dealing with his community bank for future borrower substitution and collateral and loan restructuring. He was able to win the loan and still charge a 35bps higher rate than Fannie.