The Bank Executive’s Guide to Agentic AI Platforms

In banking, there are thousands of processes that scream for intelligent automation. Many banks have adopted robotic process automation (RPA) in the last ten years and now banks of all sizes are contemplating operationalizing agentic AI. Agentic AI platforms in banking represent a transformative shift toward more autonomous systems that can perceive environments, make decisions, and take actions to meet specific goals. This integration aims to enhance operational efficiency, improve customer experience, and drive productivity throughout the banking enterprise. In this article, we explain the steps to achieve agentic AI at banking enterprise scale.

An Enterprise Architecture View of Agentic AI

Like most technology, smart banks will first look to implement an agent platform across the enterprise. That is; to gain long-run efficiency, it makes sense to have a single platform that can help the intelligent orchestration of sales, deposit operations, payments, compliance, fraud, credit and lending. A recent Gartner survey (October) of 212 banks showed that 17% of large community banks have already deployed an agentic platform and 41% plan to do so in 2026.

Use Cases for Agentic AI Platforms

Below are key use cases, potential benefits, and implementation strategies derived from the current literature on Agentic AI in banking.

- Fraud Investigation: AI agents are employed to automate investigations of suspicious transactions, reduce manual labor, and improve detection rates.

- Documentation: Banks have found an easy use case utilizing agents to prepare and check loan documentation ensuring documents are homogenous in language, all have the same borrower information, are all executed and are all complete. By utilizing agentic AI, banks can now review 100% of customer documentation and produce an audit log that highlights any anomalies.

- Customer Service Automation: Banks are leveraging AI agents to provide personalized customer interactions, manage inquiries, and support service representatives, thereby enhancing overall customer satisfaction.

- Lending and Credit: Agentic AI can streamline lending processes by automating credit decision-making where AI agents interpret complex data from multiple sources, allowing for quicker approvals and enhanced risk assessment.

- Research: AI platforms assist in synthesizing data and generating insights to support strategies and operations.

- Sales and Service Support: AI agents can automate routine tasks within sales environments, providing data-driven recommendations and freeing staff to focus on high-value interactions with clients.

Potential Benefits of Enterprise Agentic AI

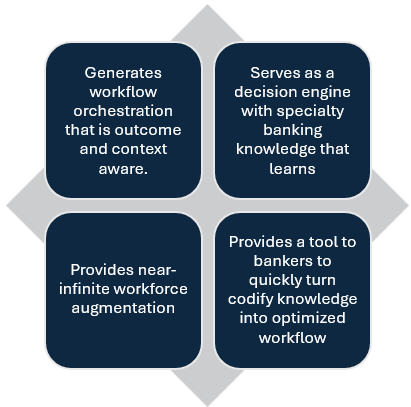

In addition to boosting productivity through automation, the rise of agentic AI enterprise platforms have four paradigm shifting impacts on banking.

Context and Outcome Aware Workflow Orchestration: Many banks utilize RPA which is static workflow automation. With agentic AI, this workflow is shifted to having the agent create and orchestrate workflow that is designed for efficient outcomes with awareness to changing environmental factors and context.

Make and Learn from Decisions: Leveraging generative AI, agentic AI can understand policies, procedures, regulatory guidance and codified best practices to make autonomous decisions.

Workforce Automation: Agents cost banks an average of about $5,000 of upfront time while multi-agents, or “agent swarms” average approximately $80,000. Agentic efforts often breakeven in months and thus can be deployed to augment bankers.

Workflow Optimization: Instead of humans creating workflow automation based on legacy processes, bankers now have a tool to help redesign processes throughout the bank. An AI agent can utilize codified knowledge of the bank to invent new workflows that are optimized. Such a tool does not exist today.

The implementation of Agentic AI in banking can yield several key benefits:

- Increased Efficiency: Automating repetitive and complex tasks allows banks to streamline operations and reduce the time taken for processes such as approval and compliance checks.

- Enhanced Decision-Making: AI systems can analyze large volumes of data in real-time, providing actionable insights that improve decision quality and reduce human error in critical areas such as risk assessment.

- Scalability: Agentic AI solutions can operate across different business functions, facilitating a more agile banking environment that adapts to customer needs and market changes.

- Resilience: Agentic AI provides banks with more optionality and operational resilience to handle a variety of tasks across the enterprise.

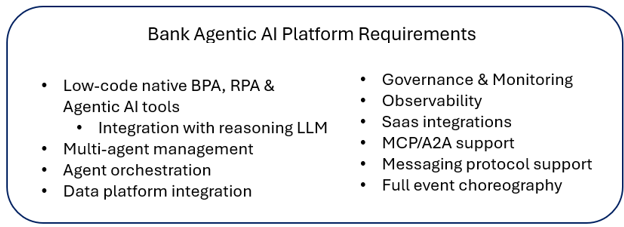

Below is our general requirements for an enterprise agentic platform in banking.

Implementation Strategies

For banks looking to implement Agentic AI across the enterprise, certain strategies can ensure effective integration:

- Architectural Shifts: Banks must design workflows that embed AI at their core, moving beyond simple use cases to more complex, integrated systems that enable real-time adjustments and autonomous operations.

- Data Readiness: Ensuring high-quality, accessible data is crucial for AI systems to function effectively. Banks should invest in creating unified data layers that support AI initiatives across business lines.

- Collaborative Training: It is vital to prepare employees for working alongside AI systems. Structured training programs should emphasize areas where AI can assist rather than displace human roles, aligning talent development with evolving operational needs.

- Governance and Compliance: Establishing frameworks for monitoring and regulating the use of AI agents is critical. This includes regulatory compliance, real-time monitoring, and enforceability of decisions made by AI systems.

Putting This into Action

At some point, a bank needs at least one agentic platform to build agents upon. This platform should be more than customer facing and should be able to be embedded into workflows throughout the bank. By addressing these aspects, banks can integrate Agentic AI technologies effectively, enhancing their service delivery, reducing cost, decreasing risk and strategic capabilities in today’s competitive financial landscape.

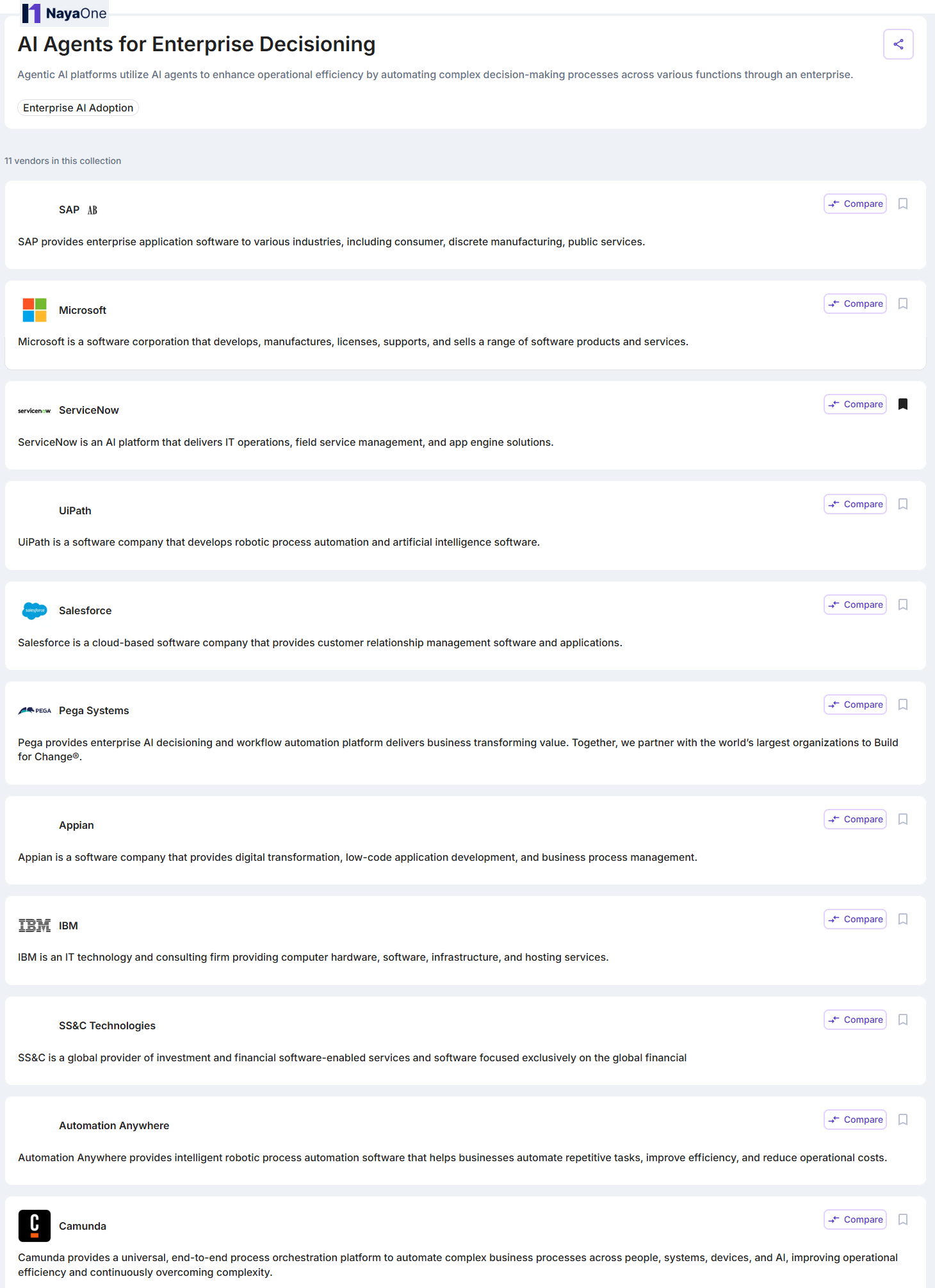

To help, we have curated some of our favorite enterprise platforms (below) that should be considered on the Compass NayaOne vendor discovery platform (free to use for readers). These all largely meet the requirements outlined above. On Compass, you can create comparison reports such as this one (HERE) to help narrow the list to choose the best platform for your bank.