Loan Hedging May Save Your Bank

We see three expected developments in 2022 that will make a loan hedging program an essential competitive advantage for community banks. Increasing short-term rates, higher expected inflation, and increased need for fee income will significantly benefit those community banks that can offer a seamless and document-friendly loan hedging program. While we have our ARC Program available to community banks, there are others. The important point is that you have access to a program and we step through the why.

Increasing Short-term Rates Promotes Loan Hedging

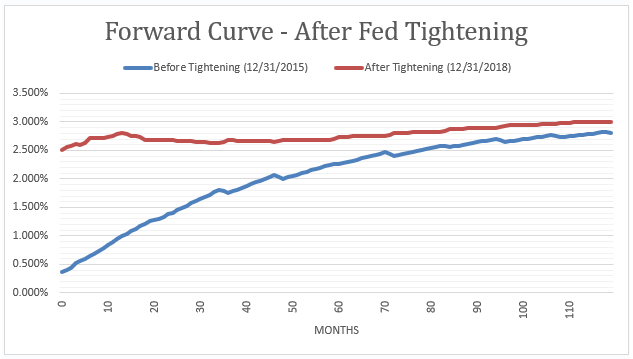

The Federal Reserve is expected to raise short-term interest rates for the next few years. When short-term rates rise, the yield curve typically flattens. This phenomenon has occurred in the last three tightening cycles, and the last flattening of the forward yield curve is shown in the graph below. In the last Fed tightening period (from 2015 to 2018), the 10-year forwards flattened by 2.01%. As the yield curve flattens, borrowers prefer longer, fixed-rate loans, and banks prefer floating-rate assets. A loan hedging program can solve this dilemma.

Higher Expected Inflation

Inflation is running higher than at any time in the last 40 years and very few bankers that are still working today have firsthand experience with how inflation affects a bank’s business model. The average community bank is a margin-generating machine. For banks under $2B in assets, in the last four years, the yield on earning assets, minus the cost of funding assets, contributed to 78.4% of all earnings (despite increased PPP fee income in 2020 and 2021). However, inflation decreases the present value of margins because the future margin on a loan has diminished economic value.

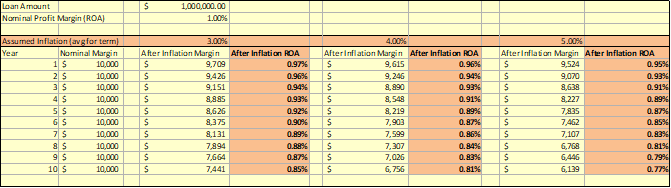

When a bank books a fixed-rate term loan, this earning asset generates a yield above the bank’s cost of funding. The average after-tax ROA for community banks on commercial loans is about 1.00%. That 1.00% net income margin on a $1mm loan is worth $10k per year, but that $10k comes in every year, and in future years the value of $10k decreases because of inflation. The table below shows the nominal margin on an average $1mm loan, at 1% ROA (profit of $10k per year) and the same dollar margin is also calculated but adjusted for erosion because of inflation. A longer time period and higher expected inflation decreases the after-inflation pretax ROA – to the point that if inflation is expected to average 5% over 10 years, the 1% ROA 10-year loan returns only 77bps ROA when adjusted for inflation over the 10 years. Few bankers have experience with this phenomenon, but a loan hedging program can convert fixed-rate loans to an adjustable rate, and offset this pernicious impact of inflation.

Source of Fee Income

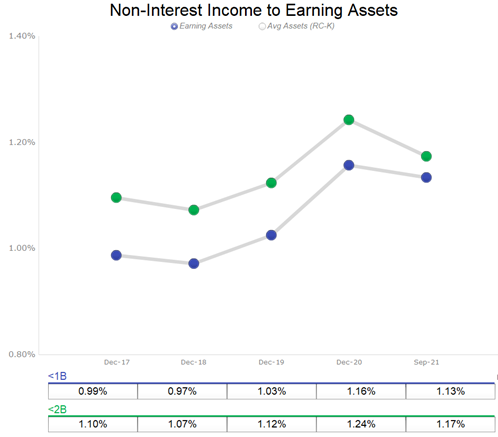

Smaller commercial banks are challenged to maintain fee income. However, in 2020 and 2021 many community banks were buoyed by PPP fees. The graph below shows non-interest (fee) income for banks under $1B and under $2B in assets. Paycheck Protection Program (PPP) loan fees added somewhere between 10 and 19 bps of fee income to earning assets.

One of the main reasons that banks hedge loans for their clients is to generate fee income. Fee income for smaller hedged commercial loans is typically between 50 to 200bps of the loan amount and is commonly recognized immediately in the period received. This is a substantial amount of non-interest income available to banks, especially as the yield curve flattens. Further, those hedge fees are not necessarily one-time fees and are often re-generated when the loan is amended, increased, or the collateral is substituted (in the case of 1031 exchanges).

Conclusion

More community banks will find that a user-friendly loan hedging program is a vital tool in not just managing risk (both interest rate and credit risk) but generating additional fee income and meeting their loan structuring / pricing strategies. Most important is that it makes your bank more relevant to your customers. In 2022 not having a loan hedging solution and experienced lenders trained on such a program may be a competitive disadvantage for many banks.