10 Loan Pricing and Structuring Observations for 2023

On our loan hedging desk, we work with hundreds of banks ranging in size from just over $100mm in assets to some national banks with over $1T in assets. Combined with our relationship profitability model, Loan Command, we see the pricing of thousands of commercial loans per month as small as $30k and as large as multi-billion dollars. Our job at Loan Command and on the ARC hedge desk is to help bankers win business, offer borrowers competitive structures and pricing, and maximize bank profitability while reducing risk. Of the hundreds of loans priced on our desk each week, some common loan pricing and structuring observations stand out in the current environment that we would like to share with our readers.

Loan Pricing and Structuring Themes and Observations

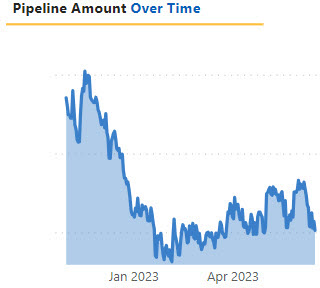

- Given the concern over credit and lower deposit performance, many banks are choosing to shrink or, at least, control growth to below 5%. Loan portfolio pipelines (below) are at about 35% from what they were in 4Q of 2022. This means that banks must be choosy on credit and how loans are structured. Weak credit is made worse by a poorly structured loan.

2. Early in our banking careers, we were taught to avoid selling products that put the bank and the client in conflicting outcomes – where the lender and borrower have win/lose positions. Unfortunately, floating-rate loans generally have conflicting outcomes. When interest rates rise, lenders do better, but borrowers struggle to service the debt. Fixed-rate loans also generally demonstrate conflicting outcomes on various levels. When interest rates rise, lenders struggle to manage revenue and economic capital; when rates fall, borrowers can commonly refinance the debt at lower rates. Better products create win/win outcomes for lenders and borrowers. We can achieve this win/win result more fully with a hedged loan, where the lender retains a floating rate, and the borrower has the protection of a fixed rate.

3. Optimal entry points are difficult to predict. We see borrowers trying to out-predict the market by guessing what the Fed might do, analyzing economic trends, studying graphs, or talking to friends at cocktail parties. No one can time the market when purchasing a stock or locking in financing costs – the market is too efficient and unpredictable. Instead, we recommend that borrowers try to ladder their debt portfolios. When borrowers have multiple credit facilities or tranches, locking in various portions at different times is the best way to minimize this entry point risk.

4. Certainty reduces risk, and borrowers that can establish payment certainty are reducing risks for themselves and the lender. The probability of default for adjustable loans that are about to reset up is often 10% or greater because of the increase in debt service cost. We urge all banks to consider this concept when structuring a construction loan and provide some perm or semi-perm takeout facility. This is a great example of how loan pricing and structuring can add value. The hedged loans allow lenders to establish forward-starting perm loans post-construction that are fixed rate and reduce the risk for borrowers and the bank. The bank can gain an above-average risk-adjusted return on equity.

5. Lenders should be able to provide their clients with appropriate context. Some borrowers express sticker shock with short-term interest rates increasing by 5.00% in less than 14 months. Some borrowers are now waiting for interest rates to normalize before refinancing, expanding, or acquiring assets. However, these borrowers are comparing current rates to the abnormal environment in the pandemic between 2020 and 2022. Lenders must point out that the correct context for comparing financing costs excludes black swan events such as the great financial recession and the pandemic.

6. Borrowers are not capital market experts and need to understand what the market is forecasting – even though the market may be wrong in its forecast. Lenders should be able to explain the construction of the yield curve. Some borrowers are waiting for interest rates to fall to refinance debt. There are two flaws to that argument. First, we don’t know for certain interest rates will be lower in the future. Second, the market expects interest rates to be lower in the future, which is already factored into current rates, resulting in an inverted yield curve. There is no economic benefit for borrowers to wait for lower interest rates in the future unless the borrower can predict better than the market where interest rates will be.

7. Banks need to have a firm understanding of non-interest income economics. For example, we recently structured a $5.5mm 15-year loan, where the borrower paid a 15bps loan origination fee and a 25bps hedge fee. The loan origination fee came from the borrower’s pocket and created substantial friction and lengthy negotiation (the fee was reduced from an initial 25bps). The hedge fee was embedded in the borrower’s rate and was never contentious. The loan fee will generate $550 of non-interest income per year. The first year, the hedge fee will generate $121k in non-interest income. The question for every banker is which fee is the higher value to the bank and which fits the bank’s business model as presented to clients.

8. Negotiating away prepayment provisions is easy for borrowers because many bankers cannot explain how or why prepayment protection is valuable to a bank. There are four main reasons why prepayment provisions increase profitability for banks. The four reasons are as follows:

-

- Decrease the value of the option held by the borrower to repay the credit when interest rates or credit spreads are lower.

- Increase the lifetime value of the relationship.

- Increase cross-sell and upsell opportunities.

- Reduce negative selection bias in an economic downturn.

A hedged loan has a symmetrical prepayment provision that trues up or creates a neutral cost/benefit for a prepayment based on interest rate movements. It allows banks to hedge the loan to make the bank and borrower indifferent to prepayment, whether rates are higher or lower. The provision better aligns with the lender’s and the borrower’s interest rate sensitivity. If a borrower takes a hedged loan for a defined number of years, that borrower wants to hold that loan for those years or believes that interest rates are not heading lower than the market expects. Further, because the symmetrical prepayment provision is a market-driven point of neutrality on prepayment, not enforcing the provision to the borrower results in the bank taking that exact cost on its balance sheet and income statement; this provision becomes a clear example of value lost or gained to the bank.

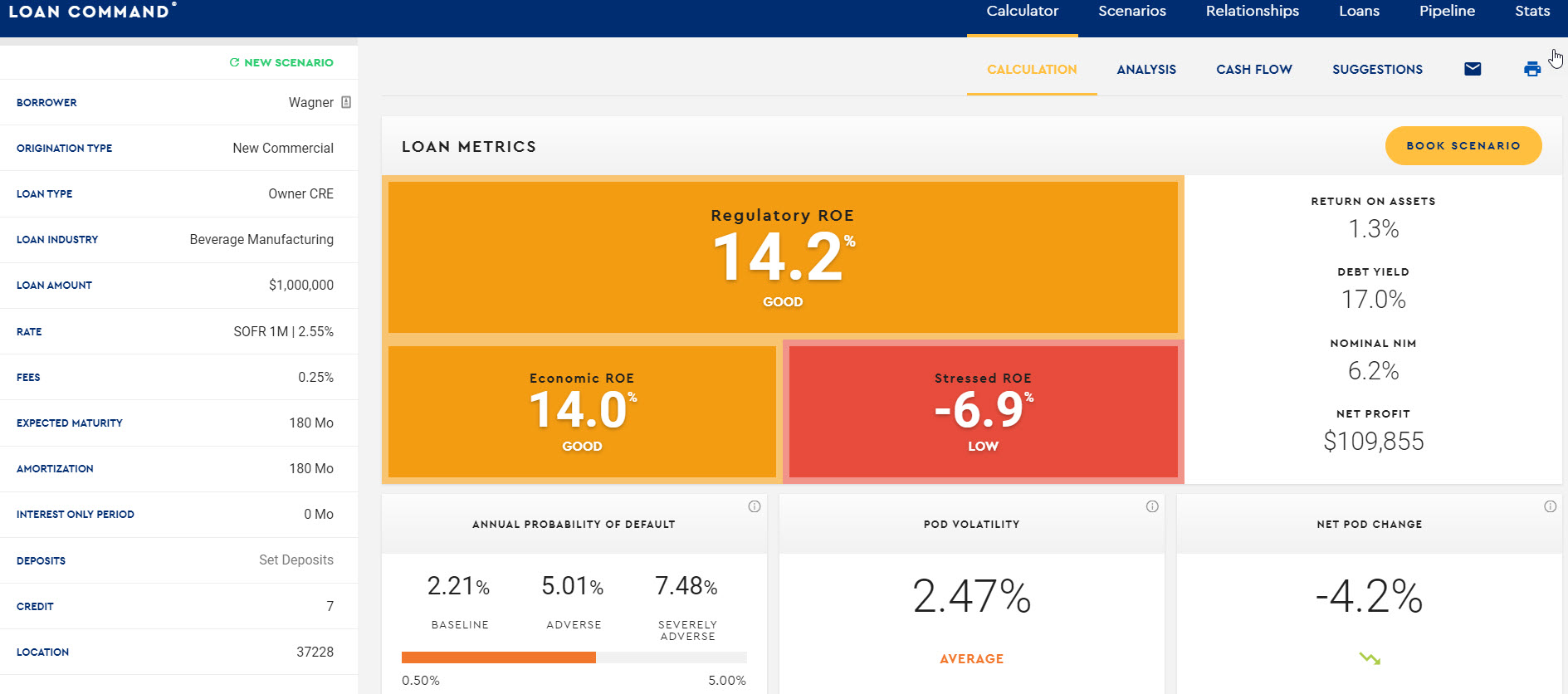

9. Pricing commercial loans based on spread to the yield curve instead of all-in rate (either fixed or floating) is the first step to fund transfer pricing (FTP). A key component of FTP is to enable front-line business units to divide interest income between their loans and deposits to a central treasury function. This allows management to better manage credit, interest rate, and operational risk in business units. All hedged loans are priced through an FTP framework and change the bank’s understanding of the makeup of net interest margin and how the bank’s activities have contributed to economic profitability. A typical commercial loan utilizing funds transfer pricing has gone from an 18.1% risk-adjusted return to now a 14% return (below). Banks with higher than average cost of funds and deposit betas will find their risk-adjusted return closer to 12%.

10. Many bankers do not hesitate to set fixed-rate loan pricing 30 to 60 days before a loan closing primarily because banks do not measure the risk of this practice. The exact closing option is available with a hedged loan where bankers can set a hedged rate before closing and solve for the credit spread when the loan is booked. However, when presented with a hedging strategy where the bank’s lending contribution to FTP is not known for 30 to 60 days, almost every banker declines – yet the same risk appears acceptable for the entire term of a balance sheet fixed-rate loan. The hedging mathematics makes the risk/return clearly visible and actionable.

Conclusion

We have always been keen on outlining practices that lead to higher performance for community banks. These practices require measuring value creation or destruction at the department, process, or individual level. Implementing some of these loan pricing and structuring best practices can be politically sensitive, but better-informed bankers lead to higher-performing banks.