Loan Hedging for Community Banks in 2024

Community banks’ use of swaps (banks’ primary tool to hedge interest rate risk on loans) has increased substantially over the last ten years. The market expects the current inverted yield curve to remain through much of 2024 (based on long-term interest rates and the expected rate cuts in 2024). Meanwhile, community banks face net interest margin (NIM) and fee income pressure. This article will discuss how national, regional, and community banks may use loan hedging programs in 2024 to face earnings challenges.

Hedging Adoption

As of Q3/23, there were just over 4.5k commercial and savings banks in the country, with $25.96T in assets and $11.87T in loans. Only 304 banks (or 6.7% of the total) used swaps directly. We estimate that approximately another 500 use hedging programs that keep the derivative off balance sheet (thus not reportable by FDIC). Such programs include the one that SouthState Bank uses for our commercial loans – the ARC Program. Therefore, we estimate that about 18% of all banks in the country offer some form of loan swaps to their borrowers. However, this 18% number is a misrepresentation. When adjusted for a bank’s loan portfolio size, approximately 69.4% of banks offer loan swaps to their customers. The 304 banks that report direct swap notional numbers also represent $8.24T of all loans in the banking system. Therefore, if your bank does not offer a loan hedging solution to your borrowers, your bank is a small minority in the domestic bank market.

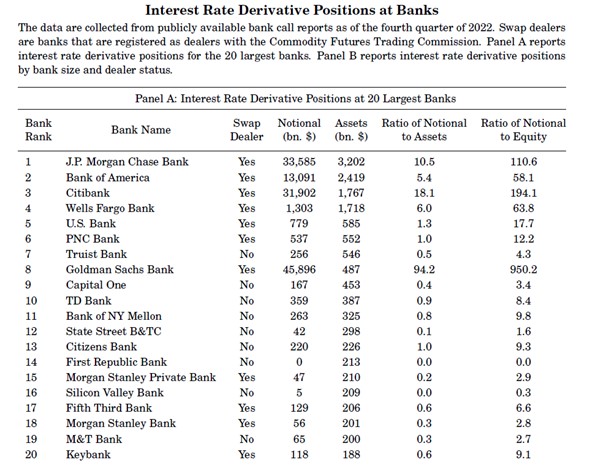

The largest 20 banks in the country by asset size and their interest rate notional swap position at the end of 2022 are shown below (from the National Bureau of Economic Research paper (working paper 31166), the authors (McPhail, Schnable, Tuckman)).

Notably, the two banks with zero or near zero swap notional at the end of 2022 are now defunct institutions (First Republic Bank and Silicon Valley Bank). This is a testament that, used correctly, interest rate swaps are risk mitigation tools, and when interest rate volatility or liquidity is uncertain, the lack of interest rate hedging may subject banks to unnecessary interest rate, credit, or liquidity risks.

Benefits to Loan Hedging for Community Banks in 2024

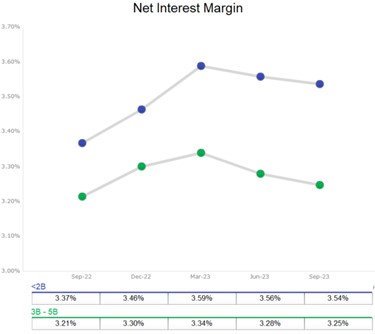

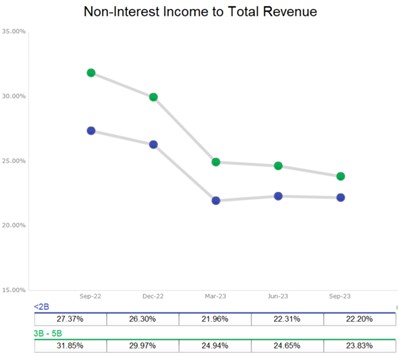

Community banks will face continued pressure on margins and fee income in 2024. The graphs below show NIM and fee income for banks under $2B and those $3-$5B in assets for the last five reported quarters.

Community banks must incorporate strategies that retain profitable relationships and shed unprofitable business. One profitable strategic opportunity for community banks in 2024 is to take advantage of an inverted yield curve to maximize NIM and use loan hedging to generate non-interest income.

The current inverted yield curve presents community banks with a novel opportunity to increase net interest margins and generate fee income for terms between three and 20 years fixed. This benefit can be applied to new or existing loans refinanced through a hedging program. Currently, for a five-year hedged loan, a bank will generate an immediate adjustable yield that is 1.54% higher than what the borrower will pay fixed – the additional income for the bank over the borrower’s payment is shown in the table below for various fixed terms.

Banks may question why loan hedging makes sense despite possible short-term rate cuts. There are multiple good reasons why national and regional banks continue to offer fixed-rate loans to borrowers only via a loan hedging program, regardless of the interest rate cycle. Community banks should also consider those same reasons, which include the following:

- Economists’, the FOMC’s, and the market’s forecasts are often incorrect, and the precision of projections falls dramatically beyond one quarter. However, the ability to recognize fee income and higher yield upfront is often a significant win for banks.

- The bank can also earn a substantial hedge fee of 1.0% to 2.5% of the loan amount. This income can dramatically boost current ROE/ROA and is retained by the bank even if the borrower prepays or refinances the loan before the contractual term. In fact, refinancing and prepays may boost the bank’s return for loans hedged in an inverted yield curve because the bank generates NIM during a higher rate environment, and the retained hedge fee can be applied economically over a shorter time. Consider that a 5-year hedged loan has an average expected life of about 4 years.

- Banks should consider the time horizon for the credit and match loan revenue and deposit costs over that time horizon. While the FOMC is broadcasting the possibility of three rate cuts in 2024, a 5 or 10-year loan will be subject to many more FOMC pivots and rate increases and decreases, which are impossible to predict today. Eliminating this future risk for the bank (and the borrower) is an essential objective of a loan hedging program. The average community bank’s COF is highly correlated to SOFR and Fed Funds rate.

- A fixed-rate loan without a hedge does not result in a yield most banks expect when rates decrease. For on-balance sheet fixed-rate loans, most banks will either not include a prepayment provision, have a soft prepayment provision, or waive that provision when pushed by an important client. Therefore, these on-balance sheet fixed-rate loans tend to prepay if interest rates drop and extend if interest rates rise.

Conclusion

We believe 2024 will be another challenging year for the banking industry, and we do not see any more clarity on interest rates or credit risk. Community banks should seek every advantage available to them in the market – one such advantage is an inverted yield curve that, through the use of a loan hedging program, can provide additional margins, fee income, and credit stability. For banks that do not want to trade derivatives directly, the ARC program offers all the benefits of a loan hedge without complex derivative documentation, derivative accounting, or monthly borrower settlements.