What the Yield Curve is Telling Bankers

Historically bankers used the Treasury, FHLB, or swap yield curve to discern the future path of interest rates. At the time of this writing, the three-month Treasury-Bill is yielding four basis points, the two-year note is 0.59%, and the 10-year note is yielding 1.33%. Historically, such a yield curve prognosticated minimal interest rate changes over the next 10 years – “steady as she goes” mentality; a market that is expecting a very modest rise in interest rates over the next 10 years. However, this is a fundamental misread of the market. The market-clearing interest rate is now telling us very little about the future expectation of interest rates. In the current levered financial system, where central banks are the market, real bond yields are now negative. Bankers need to understand why the yield curve is no longer a gauge of future interest rates.

What? The Yield Curve is Negative?

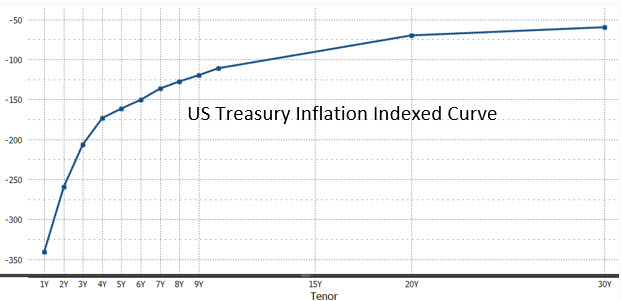

In our last article about our rate view for 2022 (HERE), we discussed the current state of inflation and how it might not be as transitory as the pundits think. It is telling to consider the current yield curve adjusted for expected inflation. This is surprising to many bankers. The graph below shows the US Treasury Inflation Index yield from one to 30 years. The curve is negative for all tenors.

The question is this: why would buyers of US debt be willing to accept negative-yielding bonds after adjusting for inflation? This appears to be one of the most significant distortions of the modern financial markets. Further, if this distortion is ever unwound (which is likely to happen at some point), it would be a painful hit on many financial institutions as the cost of liabilities exceeds the yield on a large portion of fixed-earning balance sheets. For banking, the unwind of this distortion is the better of the two possible scenarios because the alternative is that interest rates remain negative (inflation-adjusted) for the foreseeable future. Interest on deposits is a distant memory, and the yield curve is flat and negative, and the business model of earning a spread from deposits and loans is no longer viable.

The Distortion Explanation

In thousands of years of recorded history, we have not seen other instances of bond or lending behavior where interest rates have persisted at negative yields on a nominal or inflation-adjusted basis. But various factors are driving this distortion. There are three broad categories of buyers of bonds: 1) non-financial buyers such as governments and agencies, 2) forced buyers, who need to buy because of risk management or lack of alternatives (such as pension funds, insurance companies, repo users, and hedgers), and 3) discretionary buyers and speculators (retail buyers, currency hedgers, and speculators looking for price appreciation).

Central Banks

As of Q3/21, the Federal Reserve held 26% of all federal debt. The Federal Reserve’s quantitative easing currently involves the monthly purchase of $80Bn of notes and bonds. In certain months in 2021, the Fed purchased 70% of all notes and bonds issued for that month. The Fed has been the primary agent distorting the Treasury market and all other fixed-income securities that price on a spread to Treasuries.

Forced Buyers

Pension funds and insurance companies buy US notes and bonds to diversify asset risk and hedge duration and convexity of liabilities as interest rates fall (as they have). The present value of liabilities for these buyers increases. To balance their asset-liability duration, these buyers have to increase interest duration by buying more and longer-dated Treasuries. Many other institutions use repurchase agreements (repos) secured by notes and bonds. These institutions are indifferent to yield and use Treasures to eliminate risk in their overnight financing activity. The repo market is approximately $5T, and its proper function requires the daily pledging of 23% of all marketable Treasuries. That means that almost a quarter of the holders of circulating Treasury obligations are virtually indifferent to yield.

Discretionary Buyers and Speculators

Retail investors have become large buyers of indexed and passive investment products such as bond exchange-traded funds in the past decade. Because bonds have historically been diversifiers against equity markets, bond funds continue to garner investments from portfolio managers. Therefore, as retail investments in equities increases, it also spills into bond funds that need to buy Treasuries. Finally, speculators buy negative real interest yield bonds because of the potential of future price appreciation. Meaning, that while negative yield may not be attractive, the possibility of a higher negative yield in the future would lead some investors to speculate that bonds could still appreciate in value.

The interest rate market is primarily distorted by central banks. The market is also distorted by investors who care more about the return OF their capital than about the return ON their capital and institutions that cater to retirees looking to save for retirement. While the supply of the bond markets has grown rapidly, the demand has more than offset the supply – for now.

One of the biggest victims of negative real yields has been the banking sector. The “carry” strategy has been compromised with a flat and low yield curve, and NIM is depressed. Further, with short-term yields negative and liquidity plentiful, the value of deposits has declined, and bank franchise value is depressed. This is one reason why the banking industry in 2021 is trading at about 1.0 times book value versus 3.0 times for all other industries.

Yield Curve Conclusions

Bankers should be careful not to draw false conclusions from the current shape of the yield curve because the interest rate market has been distorted by specific forces that will eventually reverse. Central bankers will one day, arguably, discontinue quantitative easing, and discretionary buyers and speculators may change behavior – as they have done in other interest rate cycles. The next time bankers are asked, “what is the market telling us with this low 10-year Treasury yield?” The answer could be, “not much!”