Why Now Is The Time To Use Swap Spreads For Loan Pricing

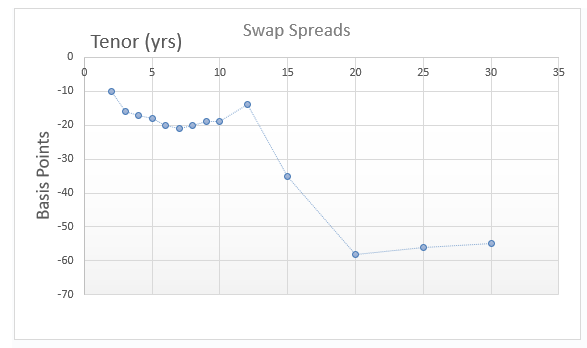

Community banks face intense competition for profitable borrowers and relationships. With short-term interest rates rising and long-term rates still at historically low levels, all bankers should understand how swap spreads may provide a competitive lending advantage. In this current market, swap spreads are negative, and banks that can utilize swap spreads in pricing loans gain a substantial pricing advantage. Banks that correctly price their commercial loans on the curve using swap rates may be able to achieve nine to 58 basis points (bps) net interest margin (NIM) gain.

Using Swap Spreads for Loan Pricing

Swap spreads represent the difference between the yield on bank financing (without the credit spread) and Treasury yield for the same maturity. Historically, this difference is positive – and that makes sense because banks fund themselves at a premium over U.S. Treasury sovereign debt. However, swap spreads are currently negative from two to 30 years. In fact, the longer the term, the more negative the swap spread – an unusual situation that may create a funding or a lending advantage for some banks. This is so unusual, the Fed saw fit to write a position paper on what negative swap spreads mean for banking back in 2018 (HERE).

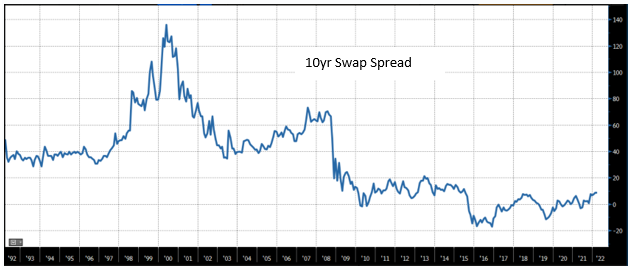

The graph below shows the ten-year swap spread over the last 30 years. The average difference is plus 32bps and has varied between negative 17 bps and positive 136 bps.

While a positive swap spread makes bank borrowing more expensive relative to Treasuries, a negative spread makes borrowing cheaper relative to Treasuries. Currently, swap spreads are negative across the entire curve – from two years out to 30 years, as shown in the graph below.

The Impact on Bank Lending

The transmission mechanism for this swap spread contraction is more critical on the lending side than the funding side. Most banks do not seek to extend the duration on the funding side beyond a few years. However, many banks fix loans for long periods, and the current negative spreads allow banks that price loans off swap rates to be nine to 58 bps more competitive than lenders who price the same loans using the Treasury curve. This is especially pertinent for banks that hedge their loans and can recognize that 58bps additional margin using the same fixed rate to the borrower, or, alternatively, offer the loan 58 bps tighter and maintain the same margin or some combination of the two.

We estimate that about 800 banks in the country take advantage of this negative swap spread (national, larger regional, and community banks that use loan hedging platforms). That means that approximately 16% of the banks in the country have an inherent and substantial pricing advantage for longer-term fixed-rate loans compared to the remaining 84% of the banks.

Some bankers are puzzled by the current tight margins on top-quality commercial loans. But when factoring the additional NIM expansion from the negative swap spreads, adding the benefit of solid credit quality and the relationship cross-sells, the math starts to make sense when using RAROC loan pricing models.

Conclusion

Community banks should consider how to compete more effectively and take advantage of negative swap spreads that can increase NIM by up to 58 bps by merely using a better curve and a hedging instrument such as our no-derivative ARC program. In a very competitive market, where loans are won or lost by 25 bps, and the credit spreads are in the 2.00% range, a 58 bps NIM advantage can be the difference between an average bank and a top-performing bank.