10 Important Bank Technology Trends and Investments for 2025

As we near the final stages of strategic planning and budgeting, several bank technology trends are emerging that will play out over the next several years. This list isn’t necessarily for bank technologists but for business line executives who make decisions on products and services. In this article, we highlight these investments, put them in order based on what we think are most important for bank performance, and provide insight into the strategy behind the investments.

Bank Technology Budgets For 2025

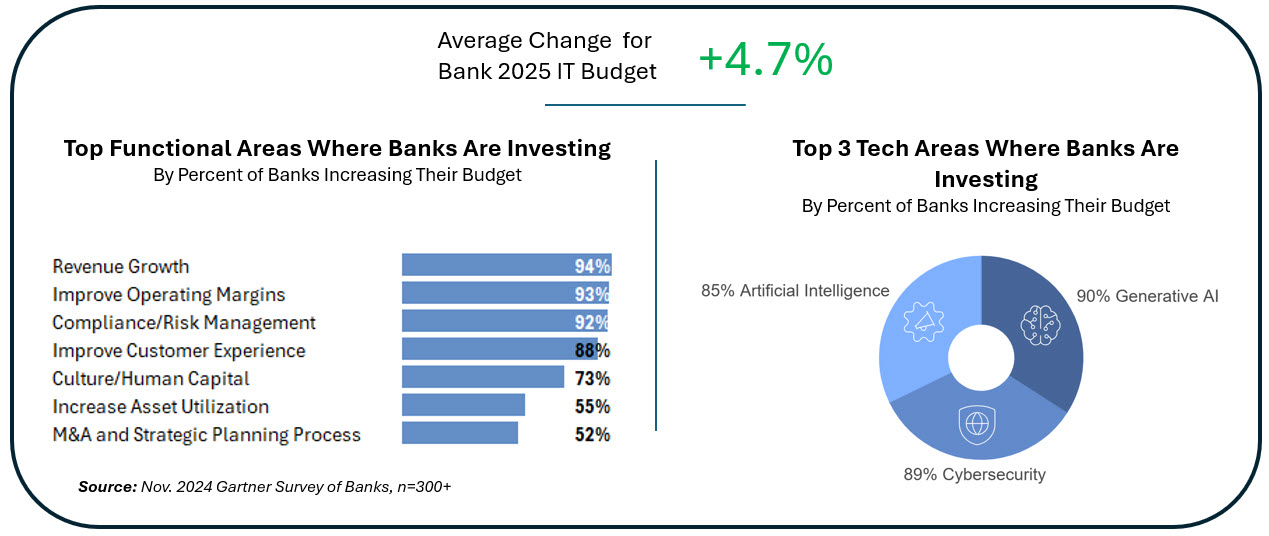

Let’s start with bank technology spending. A steeper yield curve, better credit outlook and increased projected margins have given banks more confidence to increase technology and product investments in 2025. While technology budgets are always difficult to compare, banks are expected to spend 4.7% more next year than compared to 2024. According to a recent survey by Gartner, Revenue growth, margin improvement and better risk management are the top three functional objectives, in order, for next year. It is also no surprise that generative artificial intelligence (gen AI), cybersecurity and artificial intelligence/data are the top three areas of investment for 2025.

Let’s now look at the top 10 bank technology trends and investments starting backwards.

Bank Technology Trend 10: Smartphone Intelligence

While most banks will not invest in Apple’s new artificial intelligence system (or Android’s AI), they will research its potential impact on banking.

First, any bank that provides smartphones to its employees or allows a “bring-your-own-device” policy will have to test, govern, and manage the additional risk vector since Apple Intelligence may be used more than any bank-provided generative AI (Gen AI). As of the time of this writing, it is still unclear what data gets processed in a “stateless” (on the device and not stored), what data gets stored in Apple’s “Private Cloud Compute,” and what data can be used for training.

While Apple appears to provide suitable privacy controls, a standard for monitoring solutions has yet to emerge. Popular bank monitoring solutions such as Azure Monitor, Prometheus, and Datadog are focused on enterprise cloud-based application monitoring but may not be able to handle device AI monitoring. Meanwhile, popular bank mobile device management tools such as Microsoft InTune, VMware, IBM MaaS360, and AirWatch will likely handle some level of Apple Intelligence monitoring. Still, it remains to be seen the risk gaps and how banks will need to be able to configure the security layer.

On the other hand, the opportunity that Apple Intelligence will bring to banking applications is great. 2025 will be the year that banks learn what their mobile banking platform providers have planned for Gen AI within the smartphone environment. Apple Intelligence opens better voice-to-text, access to metadata, task management integration, enhanced document search, personalization, and a host of other user interface attributes not present today.

Smartphone device AI will be brand new for banks in 2025, and most banks will not get to any implementation around Apple Intelligence. However, it will be a learning and planning year.

Trend 9: Crypto, Decentralized Finance, and Programmable Money

The blockchain is back. While this area has been dead for the last four years, the current Presidential Administration is expected to relax regulations while stoking renewed customer interest in cryptocurrency. Banks will not be investing a lot here, but on a percentage basis, the area will see more love than it has in the past four years.

JP Morgan’s investment in the blockchain-based collateral platform HQLAx, along with partnerships and investment by Visa, Mastercard, American Express, Block, and PayPal this year in crypto, has raised investment interest for 2025. Wells Fargo, Bank of America Citi, and Capital One are all expected to follow in 2025, which will fuel interest in the banking industry. CB Insights Earnings Call Analytics reports 1,271 mentions of cryptocurrency and related items as of Q3 2024 on earnings calls by analysts and financial service executives. This is a record surpassing the previous high of 2022.

Like smartphone AI, few banks will make material investments in this area in 2025, but they will readdress the need to support Bitcoin and other cryptocurrencies and undertake strategic contemplation.

Trend 8: Personalization Technology

The personalization technology stack is set to expand in the banking sector in 2025, building on the impressive gains seen in 2024, where personalized promotions achieved a remarkable 300% increase in product conversion rates compared to generic, mass offers. Banks are expected to intensify their use of tools like Personetics, Hubspot, and Salesforce Marketing Cloud, leveraging the power of data in their customer data platforms and generative AI to enhance the precision of personalized services.

This technology will enable banks to tailor their offerings more closely to individual customer needs and preferences, fostering deeper customer engagement and loyalty. This is done through push notifications in banking apps, retargeted display ads, landing pages, websites, search engine optimization, email campaigns, social media, and personalized videos. By integrating personalization into their strategic operations, banks can provide more relevant and timely financial solutions, ultimately driving greater customer satisfaction and business growth.

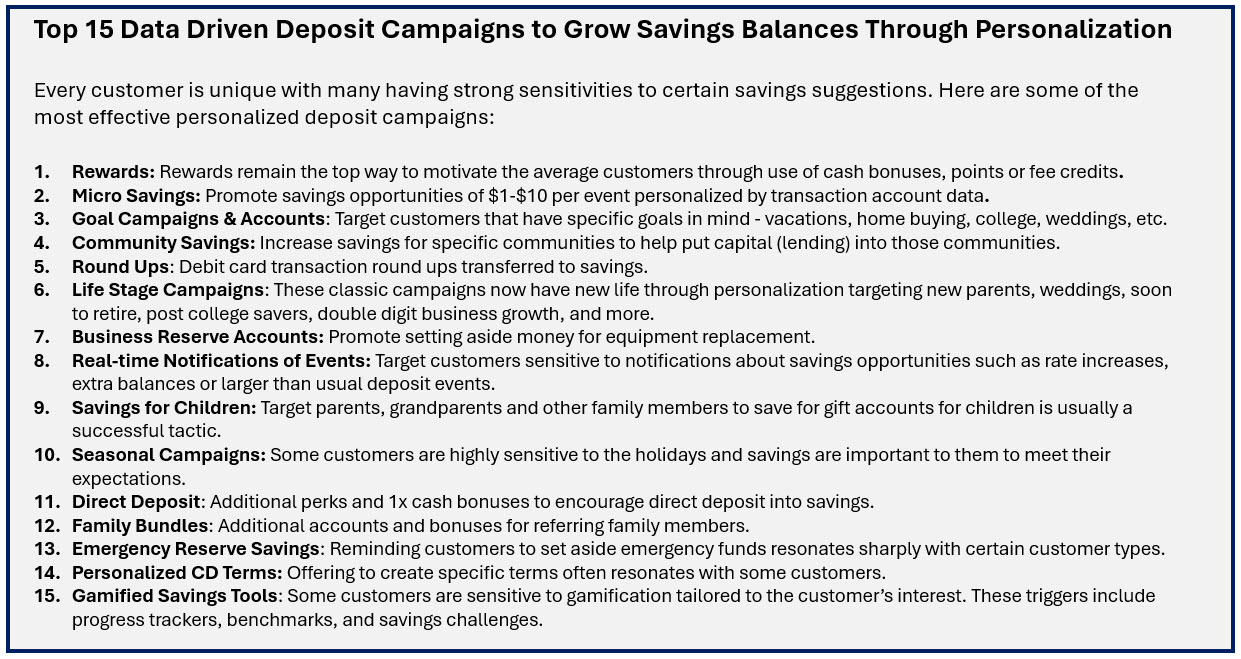

2024 was a year that saw banks make strides in using personalization in many areas, but none of them were so important as deposit gathering. Increasing data in data warehouses to include more attributes about bank products and customers gave personalization engines driven by artificial intelligence many ways to segment customers while appealing to each individual. What used to take hundreds of bank marketers, now can be done with a single banker. Marketing lifts that used to be measured in double digits are now being measured in triple digits, with return on investments well into the quadruple digits. Bank marketing has become significantly more effective and efficient.

Trend 7: Instant Payments

Like last year, banks will continue to invest in instant payments to remain relevant to customers and support treasury management. Whereas last year, banks focused on receiving payments, 2025 will focus on sending payments and allowing customers to request a payment. Banks will use this technology to cannibalize checks and wires to present a better customer experience, reduce costs, and lower risk. In addition, more sophisticated banks will continue to offer a myriad of products built on top of the instant payment rails, including pay-by-bank, instant payroll disbursements, wallet integrations, instant disaster relief funds, escrow services, and adaptive payment discounting.

Trend 6: Open Banking & Embedded Finance

Section 1033 has ignited strong interest in any bank approaching $850mm in assets to put this on the strategic roadmap for 2025. Layer on top of that the current movement with disclosing small business data under Section 1071 and the fire is ignited under the strategic imperative to make banking more open. While we may see implementation timing relax under the Trump Administration, strong interest from banks will remain because of how creating an open banking architecture makes product development and vendor partnerships much more efficient.

In 2025, banks are looking to increase investment in API developer portals, integrated payments/payables to customer enterprise applications, and integrated risk management tools for customers. Improving treasury management services is a strategic imperative for many banks due to its sheer profitability. Improving treasury management offerings by improving payments and banking service access are two tactical areas that banks will be focus on in 2025.

Trend 5: Identity and Fraud Mitigation

In 2025, banks are prioritizing identity and fraud mitigation strategies to counter the rising threats and incidents experienced in recent years. Payment channels, particularly checks and customer onboarding, will continue to get upgraded and introduce friction at the point of risk. This includes a focus on reinforcing identity verification, anomaly detection, device intelligence, automated account monitoring, and implementing robust multi-factor authentication mechanisms. Banks are emphasizing the use of artificial intelligence (AI) for early threat detection and comprehensive monitoring of access points, including APIs, to safeguard against potential breaches. A more enterprise-wide “fusion” approach will start to become more common in 2025, complete with AI-driven automated alerts. These efforts aim to fortify critical infrastructure, maintain public trust, and ensure the seamless flow of data and human capital across their networks.

Trend 4: Cybersecurity

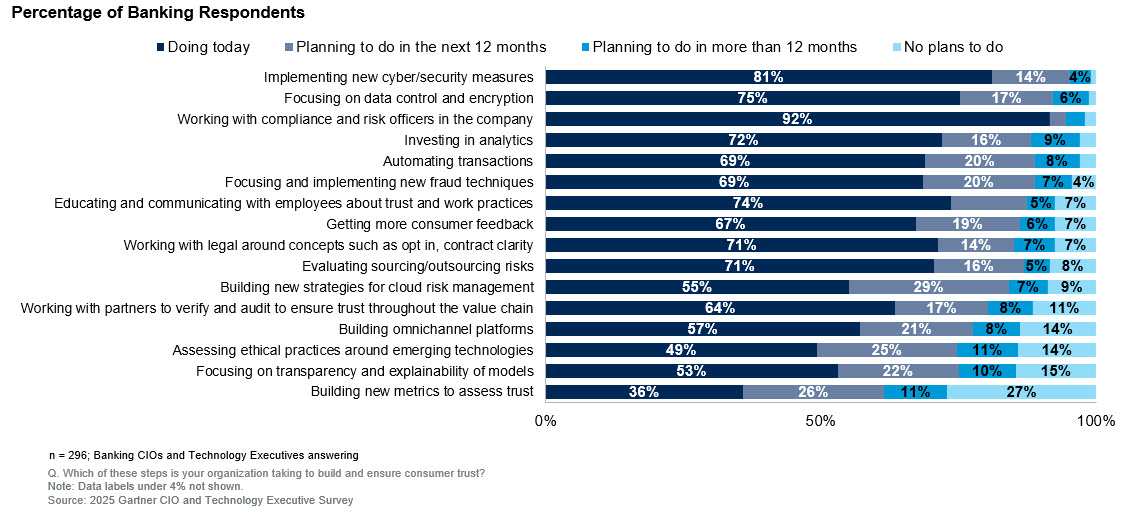

Unfortunately, the clearest trend that is emerging is the refocusing on cybersecurity, given the threats and trust-rattling events that have taken place in 2024. The increase in successfully penetrated banks has sent a clear message to the industry. Ransomware or a data breach are events that no banks want to face, and the cost of disruption, mitigation, and lack of public trust was unfortunately monetized for many smaller community banks over the last several years. Because of these trends, cybersecurity remains one of the largest functional areas of investment second only to compliance (below).

The strategic imperative is for banks to harden their infrastructure while letting data and human capital flow on a network as much as possible. It is to employ a macro-view utilizing AI so that a threat footprint can be detected early. By using AI at each endpoint to monitor access and data, increasing both internal and external education, AND using AI to bring events from logins, email phishing, and credentialling, banks might be able to get head of the bad actors.

As such, we see the following areas as priorities.

- Cloud Security: As banks become predominantly cloud-based, advanced security tools are now required for critical infrastructure. This means better data monitoring to and from cloud applications, stronger access management, and artificial intelligence (AI) detection tools to help with alerts and a fusion view.

- Zero Trust Architectural (ZTA) Enhancements: While banks have been moving to ZTA for the last five years, it is evident banks need to take it to the next level and do more compartmentalization. Banks are making investments in identity management, micro-segmentation and threat detection. For bankers, this means more logins and identity checks with almost every critical application.

- Multi-factor Authentication: To go along with ZTA, banks are enhancing their out-of-band authentication requiring SMS pins, app-drive validation codes, hardware tokens, and/or biometrics in addition to a long-in and password. This is happening internally on applications and for third-party applications that are hosted in the cloud.

- API Risk Monitoring: Given the greater interest in open banking, banks will look to harden their API capabilities with threat protection, monitoring, and access controls.

Trend 3: Data Management and Enhancement

This is a continued evolution to get a single source of consolidated truth within a bank with the goal of getting a 360-degree view of the customer and of bank operations. This means more investment in data lakes, customer data platforms, customer relationship management systems, data management tools, and AI layers for the data. Every reduction in an Excel spreadsheet full of data is a success.

Over the last three years, banks have seen the customer experience and productivity gains from being able to serve and visualize clean data. In 2025, it is time to go beyond the core data and further consolidate disparate systems and third-party data to create a more meaningful picture.

Trend 2: Origination/Account Opening, Onboarding, and Maintenance

By now, most banks have multiple applications where a customer or prospect can open a new account or enroll in a new product. In 2025, this trend will continue as banks mature these platforms to handle account maintenance, new products, and new departments. Maybe a bank has a consumer deposit account opening and lending but not commercial, or maybe its enrollment in treasury management. Whatever the case, banks will likely be prioritizing their next highest return on investment when it comes to digital transformation.

The Number One Bank Technology Trend: AI, Agentic AI and Gen AI

Like last year, this is our number one trend when it comes to bank technology spending growth. In 2024, banks (or their employees outside of the bank) have dabbled in gen AI spending little. Now that they understand the power, it is time to come up with a more comprehensive strategy and training to start implementing gen AI and gen AI-powered agents (HERE).

Generative AI is set to permeate every facet of banking, including technology development, sales, customer service, asset allocation, pricing, underwriting, and risk management. Gen AI has two major unlocks in banking, benefiting it more than most other industries. One huge advantage for the banking industry is the fact that banking is the king of valuable unstructured data (think credit reviews). Gen AI can bring structure to the unstructured data, turning all that data into valuable insights that can reduce the risk of a bank that is eight times more leveraged with credit and interest rate risk.

The other significant advantage that gen AI will bestow on bankers is the democratization of data intelligence. While every facet of every industry suffers from the lack of data intelligence, banking is this perfect convergence of sophisticated products, experienced employees, unquantified risk, and outsized financial impact. Bringing quantitative rigor to activities like deposit pricing, loan structuring, capital allocation, fraud management, security, branch management, and hundreds of other activities will benefit banking more than most industries.

Before gen AI can be deployed however, banks will spend 2025 setting up their infrastructure, developing AI inventories, establishing testing procedures and standing up a governance platform.

In 2025, banks will come to realize that they will not be able to monitor and manage gen AI models from 100+ different vendors for critical tasks and will start to consolidate models on a single platform to handle various critical tasks within the bank such as customer service, sales coaching, knowledge retrieval and thousands of other use cases.

The same will be true for agentic AI where gen AI can now take action with either a human-in-the-loop or manage the process with a human-on-the-loop. 2025 will be an exploratory year for banking as they explore the governance, risks, and opportunity of putting agents to work on the bank’s behalf. Many banks will be creating a strategy on how they will deploy agentic AI on a single platform across the enterprise.

Bank Technology Summary

Over the last three years, banks have gained significant benefits from clean data in terms of customer experience and productivity. In 2025, the focus of bank technology investment will shift to further consolidating disparate systems and third-party data for a more comprehensive view. Banks will continue to mature their platforms for account origination, opening, onboarding, and maintenance, prioritizing products with the highest return on investment.

Generative AI (gen AI) remains the top trend when it comes to bank technology spending growth. Banks will be moving from experimentation to implementing comprehensive strategies and training. Gen AI will permeate all aspects of banking, offering significant advantages such as structuring unstructured data and democratizing data intelligence. Banks will use 2025 to set up infrastructure, develop AI inventories, establish testing procedures, and create governance platforms.

Banks will also consolidate gen AI models on single platforms for critical tasks and explore agentic AI, allowing AI-powered agents to manage processes with human oversight. 2025 will be an exploratory year for governance, risks, and opportunities in employing AI agents in banking.