The Impact of Last Week’s FOMC Meeting on Bank Lending

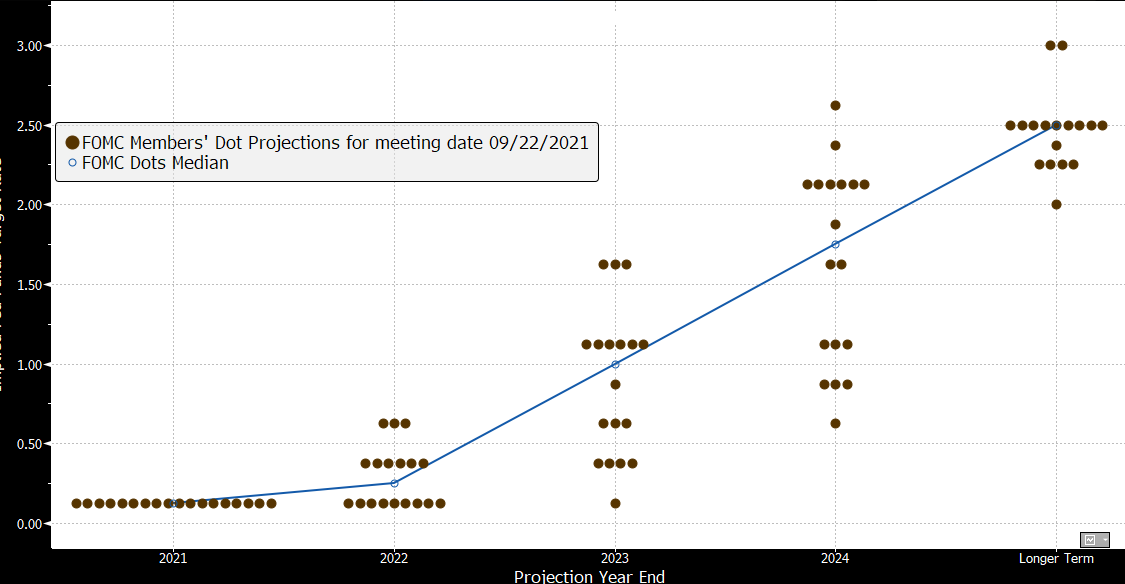

The Federal Reserve Chair, Jerome Powell, was clear last week that the central bank is highly likely to start reducing asset purchases in November and complete the process by mid-2022. As shown in the dots plot, the FOMC members also expressed an inclination to raise interest rates next year (see graph below) – a shift from the June dots plot. The long-term terminal rate for short-term rates is 2.50% which is 75bps below the average community bank term loan yield.

There are a few key elements about the Federal Reserve economic projections, Powell’s testimony, and market conditions that bankers should consider. Bankers should heed both what was said and what was omitted because the impact on the community bank business model can be important.

Our Conclusions From The FOMC Meeting

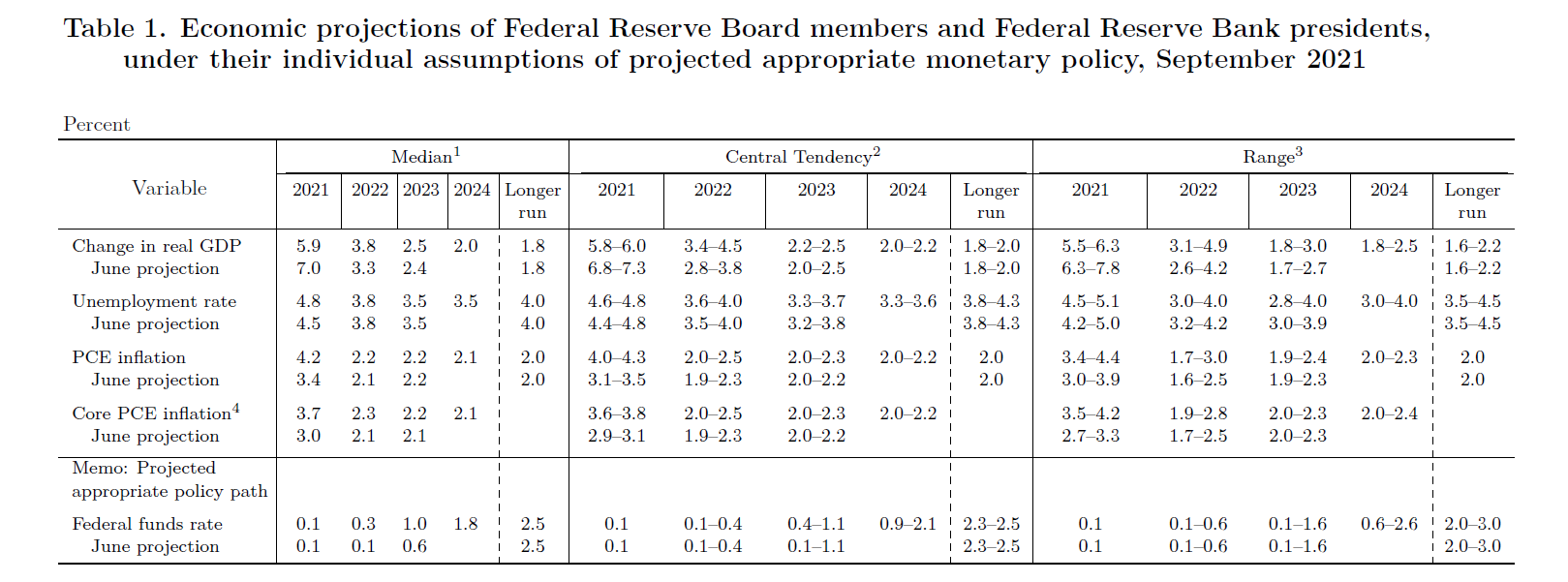

First, the Federal Reserve’s median economic projections (shown in the table below) demonstrate that the FOMC’s dual mandate will be met by the end of 2022. The ranges around the projections are broad and, therefore, the change in monetary policy may be more rapid than the market expects.

Second, Federal Reserve’s economic projections are not credible for a number of reasons. On inflation, it is inexplicable how rising inflation in 2021 (PCE projected to average 4.2%) will return to the board’s approximate goal of 2.2% in 2022. This reduction is at odds with most communication from CEOs and with the TIPS market, and with consumer expectations. As we have stated before, everything is transitory – inflation in the ‘70s eventually ended, and nothing is permanent. The supply chain bottlenecks are likely to worsen and not reverse next year. The decoupling of the two largest economies is only starting, and the export of deflation from China is ending. Therefore, while inflation may be transitory, its trajectory is now well above the FOMC’s goal. On the labor-market conditions, Chair Powell has already acknowledged that conditions for monetary tightening have been “all but met”. The BLS measure of US job openings now stands at 10.9mm – the largest number ever recorded. The argument many make is that monetary policy is intended to bring the horse to water, but it’s up to the horse to take the job if it’s thirsty.

Third, the central bank’s forward guidance is an outcome-based decision, and the officials’ monetary decisions depend on the horizon over which it can be communicated. Policymakers are now acknowledging the risk that they can be wrong on inflation and full employment. However, they also do not want to look too eager to tighten. If above-trend inflation is still present in 2022, then the dots might be substantially underestimating the pace of tightening.

Three Implications for Community Banks

First, community banks should be prepared for a reduction of liquidity in the latter part of 2022. Therefore, bankers should expect a decrease in asset sensitivity and increased loan to deposit ratios, everything else being equal. It is too early for community banks to start running CD specials, but this will be a serious consideration for some banks in 2022.

Second, in the next few months, the more sophisticated community bank borrowers will analyze the FOMC communications, consider market data, and conclude that now is prime time to secure fixed-rate financing for as long as possible. This was already the modus operandi for the large corporates and middle-market borrowers over the last 18 months. We can now expect the more sophisticated community bank borrowers to come to the same conclusion – to fix their borrowing costs at historically low levels before interest rates rise further. Smart lenders will position their bank to take advantage of this borrower demand, and one way to do so is to show borrowers the tradeoffs between refinancing now versus waiting until the contractual maturity of their existing debt. In the near future, we will be sharing the calculator that we use to show this exact tradeoff based on the forward curve.

Third, banks should develop products that specifically appeal to borrowers in a rising interest rate environment and still protect the bank’s balance sheet. We recently published a blog that covers this specific topic here . For ease of reference, community banks should be considering how higher interest rates and higher inflation change borrower behavior, and those same variables impact the bank’s NIM and EVE.

Conclusion

The FOMC does not want to look too eager to raise interest rates, but that decision will be made sometime in the middle of 2022. The risk is that Federal Reserve has been numb to the risk of higher prolonged inflation. Also, an accommodative monetary policy that has led to 10mm open job positions will very soon need to be reversed.